Thinking About Scaling Your Firm? These Podcasts Will Help

Share this

XY Planning Network’s weekly podcast, XYPN Radio, launched in August of 2015, and since then, Alan (and recently, Maddy Roche) have talked to a lot of financial advisors about a lot of things. They’ve covered breaking away from your broker-dealer, launching and successfully running a firm (which are two very different things), what to expect in the first year, and much, much more.

As the years since the podcast launch have passed, the firms of XYPN advisors have grown. More and more XYPN members are hitting the “Scaling” phase in their firm journey.

At this phase, an advisor has 75 or more clients, is hitting their personal capacity, and needs to make some decisions about the future of their firm. Do they need to hire? Merge? Put a waitlist in place to manage the new client load? These questions can feel momentous, because they are.

After joining the XYPN team two years ago, I consumed episode after episode of #XYPNRadio to better understand the members, the Network, and the financial planning industry. I listened to almost (if not all) of the episodes.

I’d argue that every episode of the podcast is worth listening to simply for the unique perspective each one has to offer. However, I also realize many of you don't have time to listen to 200+ episodes of a podcast. If you’ve hit the scaling phase and are wondering what’s next, you're in luck: I’ve identified the five must-listen episodes of #XYPNRadio.

I hope this list makes your next listening decision a little bit easier.

For Merging Firms

XYPN Radio Episode #235

About 70% of the new members who join XYPN each month are starting their own firm. They could be coming from a wirehouse, insurance, another RIA, or a different field entirely.

Regardless of where they came from, they share a destination: they’re all becoming solopreneurs. When you start your own firm, you make a huge investment in yourself, your skills and your vision. It’s scary. It’s also incredibly rewarding. So why would you give it up?

That’s the question that Maddy Roche tackles with Trevore Meyer, Rob Stoll, and Michelle and Stephen Smalenberger in Episode 235. Trevore, Rob, and Michelle are all members of XYPN; but before mid-2019, they all owned and operated separate firms. Now, all four are equal (25%) owners in Financial Design Studio (FDS).

What I loved most about this podcast was the in-depth detail about the process and result of merging. Merging is a HUGE question among members, primarily because it’s full of so many unknowns. How do I find a firm to merge with? How do I start that conversation? How do I structure it? What technology do I use? And how do I know I’m making the right decision?

This episode covers it all.

Michelle and Stephen started the merging process in early January 2019 with an honest evaluation of what they did well and what areas they could improve upon. Through their evaluation, they realized the lacked expertise in technology, insurance, and investments…these happen to be areas where Rob and Trevore excel.

When Trevore and Rob were presented the opportunity to merge with Michelle and Stephen, both had to seriously consider the offer to join FDS before accepting. Rob mentions how you view your firm as “your baby”, and don’t want to give away control. But he explained he asked himself, “Why am I in this business? Am I in it for myself or am I in it to make a difference with clients?” He quickly saw that merging would benefit his clients. Both Trevore and Rob highlighted letting go of your ego as a necessary step for anyone considering merging.

They also emphasize that merging may not be right for everyone. Michelle freely admits there are single advisor firms that manage the same amount of clients the four advisors of FDS collectively service. But that structure comes with trade-offs. For FDS, each owner has gained the ability to truly step away from their firm and take a vacation, which is more important for them.

Listen to this podcast if…

- You’re hitting capacity and are thinking of hiring

- You’ve been approached with a merging offer

- You’re considering approaching someone with a merging offer

- You’re in the process of merging, and want guidance on how it can end up

For Those Building A “Lifestyle” Practice

XYPN Radio Episode #222

Within the XYPN community, there’s an ongoing conversation about building a “lifestyle” firm. Traditionally, that’s been understood as a firm with no employees, where you have the freedom to completely dictate your firm’s directory and growth. In the most recent episode featuring Eric, he and Alan explore his changing view of what a lifestyle practice can mean.

He explained that for a long time, he felt like his firm was “on fire” in some way. At one time, it was when four clients left in a month, but more recently, it’s been the result of rapid growth. In 2018 alone, Eric doubled the size of his business. He said the feeling that he was “back on the hamster wheel” caused him to pause, because that’s the feeling he worked so hard to escape when he stepped away from the corporate world.

Eric’s episode is an exploration of what it means to intentionally grow your business, even if that vision isn't clear from the beginning. He talks about the importance of stepping away to gain perspective on his firm instead of constantly grinding. He discusses the conversations he’s had with Kali, his business partner and wife, about what’s really possible with the way their firm is growing. Eric explains he’s trying to push his mind and the limits of what’s possible, and not fall prey to getting stuck in the mentality of “this is how this has to be done.”

While he’s not sure what exactly his firm will look like in five years, he does know what’s important to him. He shared, “I’m scared to death of getting to that point where I don’t have a life, because I love my life.” With this in mind, he’s been rethinking what a lifestyle practice really means. For him, it means maximizing the lifestyle he has both in work and outside of work, even if that means hiring and managing others.

Listen to this podcast if…

- You’ve hit an inflection point with your business and aren’t sure where you’re heading

- You’re interested in building a lifestyle practice

For Those Ready to Scale

XYPN Radio Episode #82

For most firms thinking about joining XYPN and for those advisors already in the Network, growing to the size of a $1 billion AUM firm isn’t typically in the scope of possibilities when you're just getting started. But it could be down the road. If you want to know what’s possible and what’s involved in scaling a firm of that size, listen to this podcast.

JD and Alan go in depth discussing what’s required as far as structure and hiring in a large enterprise firm. They explain the importance of investing in operations, and the difference between hiring a COO and a director of operations.

They also dive deep into governance structures of a large firm, including how to select and compensate board members and shareholders and construct protections for minority shareholders.

JD talks about his philosophy around hiring and compensation. His firm looks to hire when they notice growth is slowing, which he now knows means the sales team is hesitant to add more work to staff members who are already over-capacity. They discuss the difficulties of structuring compensation packages, but the importance of making sure your compensation is aligned around a singular goal and actually motivates employees towards that goal.

Listen to this podcast if…

- You’re at an inflection point and want to grow BIG.

- You’re having partnership and compensation discussions within your firm

- You’re managing multiple employees and want to install operations

For Those Who Are Hiring

XYPN Radio Episode #81

You have a problem. You need to hire. You KNOW you do because any free time you had before has vanished. And yet you can’t possibly imagine training the new hire, because you don’t have any time. See the problem? Michael Kitces calls this hitting the “time wall” and in this episode, both he and Alan share their experiences with the time wall.

This episode dives into the difficulties of hiring, both from a process and mental perspective. They agree that hiring is HARD. They share just how hard it can be to let go of something you always thought you’d do in your business, whether that’s sales, blogging, operations, you name it, when you have to face the reality that you simply don’t have the time to do it all.

When you hit this time wall, business structuring and a clear vision become so important. Michael and Alan lay out the differences between building a business, where you’re focusing on running the business, and a practice, where you’re acting as the primary advisor for clients. This decision will help guide whether or not you need to hire. If you want to continue to work as an advisor for the foreseeable future, they explain your focus should be scaling the business you already have. That could include implementing a waitlist, scaling down your marketing, or improving your existing processes.

But if that’s not your direction, at some point your question will be what position to hire or service to offload work. As you begin to value your time more, they offer the advice of focusing on the highest and best use of your time at work. If that isn’t bookkeeping, hire FA Bean Counters. If that isn’t investment management, hire a TAMP like XYIS. If you’re having difficulty keeping up with the amount of time you spend in eMoney, hire a paraplanner. Being honest and aware of your capacity and your strengths is key to identifying ways to offload work. Alan talks about overcoming your own arrogance and the belief that no one could possibly do these things better than you can because it’s very likely that others can do a better job, especially if they have their full time to dedicate to doing those things well.

But who exactly should you add to your team? Both Alan and Michael advocate for attempting to create a well-rounded team. Find others who are good at the things you’re not. They mention both Kolbe and StrengthFinders as personality assessments to help you identify these areas, which can be useful. They also stress that you can’t put complete opposites into a partnership or team and expect them to work well together—you have to speak the same language.

Listen to this podcast if…

- You’re hitting capacity and thinking of hiring

- You’re not sure which position you should post

For Those Struggling with Impostor Syndrome

XYPN Radio Episode #40

Carl Richards has written about impostor syndrome extensively, so this may not be the first time you’ve come across his thoughts on the topic. Even if you’ve read him before, his conversation with Alan back in 2016 is worth a listen.

Carl defines impostor syndrome as having “a hard time internalizing your own success despite external evidence to the contrary.” It usually rears its ugly head when you’re doing something new and novel. While this feeling shows up when you’re a “newbie” at something, he discusses how, ironically, the more successful you are, the more impostor syndrome can weigh you down.

When you first start your business, others may be expecting you to fail. After five years of success, now they’re expecting you to succeed. Carl explains these increased expectations can amplify feelings of impostor syndrome. It can show up doing activities you may have done before because the expectation is now multiplied as your success has increased. Speaking in front of 100 people five years ago? Impostor syndrome—who let me be a speaker? 1,000 people today? There’s that same feeling again. How can I speak in front of one thousand people?

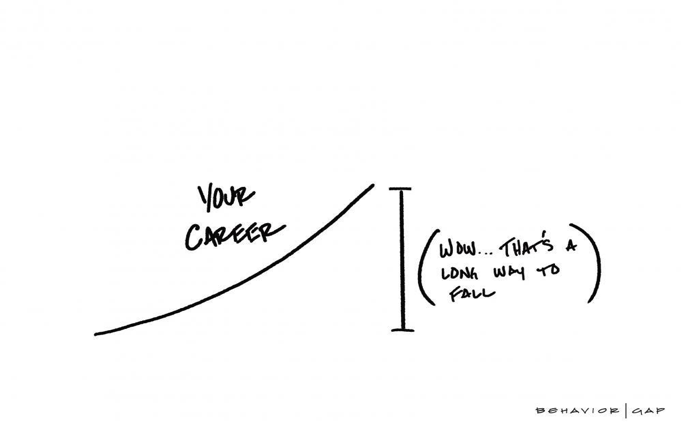

While this episode is useful for all advisors, it’s especially useful for members in the scaling phase because they’re experiencing success and yet they’re still struggling with impostor syndrome. They’re about to make some big shifts in their firm that will change its trajectory for years to come. That’s scary. They may feel unworthy or unable to make those decisions. And the prospect of failure, as depicted in the image above, can feel much more daunting once you have experienced that initial success.

My biggest takeaway? Whenever you feel you’re not good enough, or you can’t possibly do this, take Carl’s advice: lean into those feelings because they mean you're about to do something amazing.

Listen to this podcast if…

- You’re about to launch a new offering or initiative in your firm

- You notice you’re feeling apprehensive about taking new risks in your business

Conclusion

The scaling phase is an exciting place to be because of all the possibilities it holds. But first, you need to answer one very important question: what do you want to grow into? The podcasts above can help spark new thoughts or considerations you may have neglected when contemplating your answer.

Want to take it one step further? One of the greatest resources you have at your disposal is other advisors. Not sure how to find other like-minded advisors? Check out our VIP community on Facebook (XYPN membership not required).

About the Author

About the Author

As a Member Experience Specialist at XYPN, Taylor Deardorff enables our members to take advantage of XYPN's ever-growing range of benefits. Through consistent communication with our growing Network, Taylor has become intimately familiar with the needs and challenges our advisors face servicing their clients and growing their RIAs. She loves XYPN's members and sharing the XYPN message.

Share this

- Advisor Blog (700)

- Financial Advisors (223)

- Growing an RIA (121)

- Digital Marketing (88)

- Marketing (85)

- Community (81)

- Business Development (79)

- Start an RIA (76)

- Coaching (72)

- Running an RIA (71)

- Compliance (69)

- Client Acquisition (65)

- Technology (65)

- Entrepreneurship (61)

- XYPN LIVE (61)

- Sales (49)

- Practice Management (44)

- Client Engagement (41)

- Bookkeeping (40)

- Investment Management (40)

- Fee-only advisor (38)

- XYPN Books (38)

- Scaling an RIA (34)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Financial Education & Resources (27)

- Client Services (26)

- Journey Makers (23)

- Market Trends (21)

- Process (14)

- Niche (11)

- SEO (9)

- Career Change (8)

- Partnership (7)

- Transitioning Your Business (7)

- Sapphire (4)

- Transitioning To Fee-Only (4)

- Social Media (3)

- Transitioning Clients (3)

- Emerald (2)

- Persona (2)

- RIA (2)

- Onboarding (1)

Subscribe by email

You May Also Like

These Related Stories

How Marketing Can Help You Build a Firm for the Future

April 2, 2018

14 min read

At The Capacity Crossroads: 3 Visions For Scaling Your Advisory Firm

Jun 17, 2021

5 min read