The AI Revolution in Wealth Management: How Advisors Can Stay Ahead of the Curve

Share this

Imagine a world where financial advisors can spend less time on tedious tasks and more time delivering personalized, high-value services to their clients. This world is not a distant future – it's today, and artificial intelligence (AI) is making it possible.

As powerful AI tools like ChatGPT, Google's Bard, and Microsoft's Bing AI continue to advance, advisors who embrace this technology stand to gain a significant competitive edge. By harnessing AI, advisors can streamline operations, enhance client support, and unlock new growth opportunities.

However, with great power comes great responsibility. As the SEC ramps up its focus on AI-Washing in financial services, it's crucial for advisors to understand the regulatory landscape and ensure they are using AI safely and transparently both for internal workflow processes and any client-facing materials.

In this post, we'll explore five key areas where AI is revolutionizing financial advisory, showcase real-world examples of advisors leveraging these tools, and discuss best practices for responsible AI implementation.

We'll also take a deep dive into Advisor Core by YourStake, an industry-leading AI-powered platform that empowers advisors to convert prospects into clients faster than ever before. To move from prospect brokerage statement to portfolio proposal in minutes.

Where AI Can Help Advisors Now

Marketing and Content Creation

AI-powered tools can assist advisors in creating great first-draft emails, blog posts, website content, and even newsletters. This not only saves time but also ensures that the content is tailored to the specific needs and interests of your client base and can even be made to mimic your own voice.

Client Support

AI can help advisors provide better client support through automatic alerts, client segmentation, and customer support chatbots. These tools can quickly address common client queries, freeing up advisors' time to focus on more complex issues. Additionally, these tools can be on 24/7 to help support clients anytime they need assistance and alert you to anything missed.

Notes and CRM

Advisors can use AI to generate meeting transcripts, summaries, and evaluations, as well as automatically convert meeting notes into CRM fields. This streamlines the note-taking process and ensures that important information is captured and organized efficiently allowing you to focus on your prospect or client.

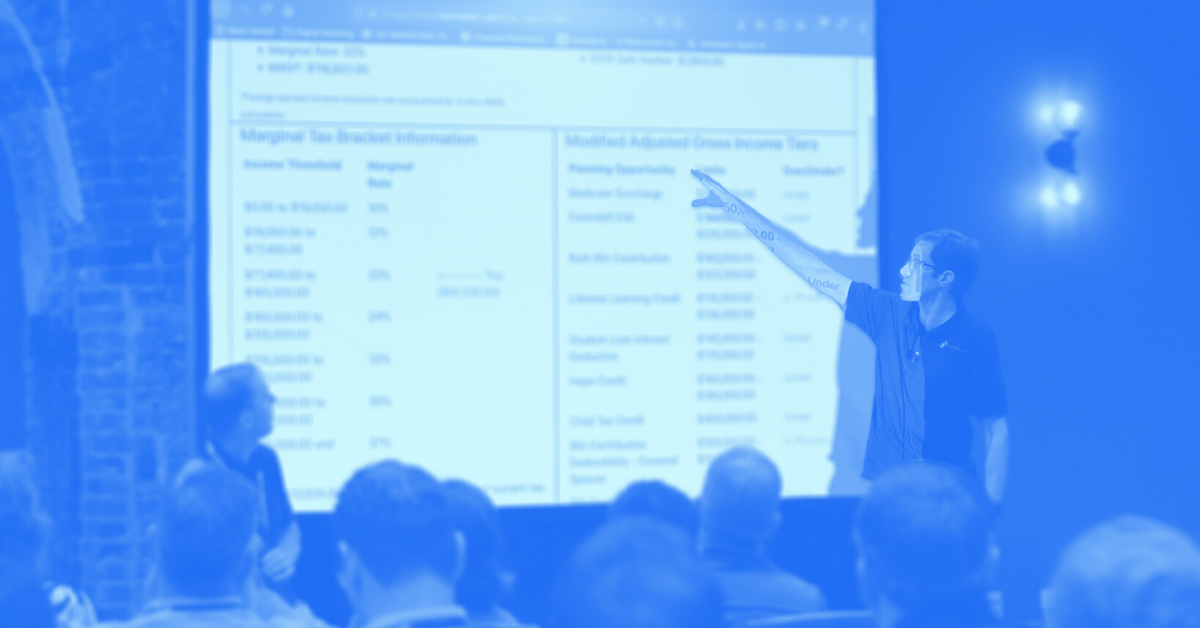

Document Extraction and Presentation

AI can read and format information from PDFs, providing instant personalized analysis and presentations. This is particularly useful for tax planning and proposal generation, where advisors need to quickly extract relevant data from multiple sources.

Analysis Assistant

AI can help advisors understand market commentary and derive portfolio insights, enabling them to make more informed decisions and provide better advice to their clients.

Growing and Scaling Your Practice Through The Use Of AI

While all these AI applications are incredibly valuable, the biggest barrier for advisors is often converting prospects into clients. While it does take some marketing efforts to grow your prospect funnel, nurture leads, and bring some lead-generation opportunities into play, it goes beyond that, and applying a cohesive conversion process for the prospect is the secret to early and sustainable growth for many.

This is where Advisor Core by YourStake comes in. Advisor Core is designed to help financial advisors grow their business by reducing the time it takes to analyze a prospect's financial situation and generate a proposal so you can give the prospect what they’re looking for in minutes, not weeks.

The typical path for high-growth RIAs to convert a prospect to a client involves several steps:

.png?width=2100&height=1350&name=Converting%20Prospects%20to%20Clients%20(2).png)

1. Initial contact and meeting: Prospective clients make contact through web forms, phone calls, walk-ins, or referrals, and have an initial meeting with the advisor.

2. Collect financial information: The advisor requests information about the prospect's investments to prepare an investment analysis and plan. Additionally, risk tolerance questionnaires and even values-discovery processes can be used to give a comprehensive view of their financial and life goals.

3. Internal analysis and proposal preparation: Advisors review the financial statements and identify gaps between the prospect's current situation and their expressed goals. This process typically takes anywhere from one day to one week depending on the assets the prospect has and the complexity of their goals.

4. Client decision: Advisors and staff present the proposal to the client and begin the relationship if they are aligned.

5. Client onboarding: The client begins the onboarding process with the advisor and the relationship-building process continues!

Advisor Core focuses on reducing the time between steps 2 and 3, which is often the most time-consuming part of the process. By leveraging AI, Advisor Core reduces the analysis and proposal preparation time from days to just minutes.

How Advisor Core Works

1. Upload client statements and questionnaire: Advisors can upload any client brokerage statement into Advisor Core and our OCR and AI processes extract that data in minutes. Additionally, risk tolerance and values alignment tools can be used to add deeper analysis to the current financial landscape of the prospect while providing a personalized experience.

2. Instant portfolio analysis: Within minutes, Advisor Core generates a formatted spreadsheet containing the prospect's holdings and provides instant analysis of the uploaded portfolio against a set benchmark, or existing model you might use.

3. Chat with portfolio: Advisors can use the chat feature to ask questions and glean insights about the prospect's portfolio, helping them quickly identify areas for improvement or optimization. This is like having a second set of eyes with you as you move through the process and even generating talking points for you to use with your prospect.

4. Customizable presentation output: Based on the analysis and insights, Advisor Core generates a customizable, on-brand presentation that advisors can use to present their proposal to the prospect, better yet, using the live analysis can be a tech-forward and interactive experience a prospect would be impressed with.

By drastically reducing the time it takes to analyze a prospect's financial situation and generate a personalized proposal, Advisor Core empowers advisors to move quickly and efficiently through the conversion process.

This speed and efficiency are critical for high-growth RIAs looking to scale their business and take on more clients.

In addition, Advisor Core's AI-powered features help advisors provide a more comprehensive and insightful analysis of a prospect's portfolio, demonstrating their expertise and value proposition right from the start. This can help differentiate advisors from their competitors and increase the likelihood of converting prospects into long-term clients.

From personalized marketing and content creation to advanced portfolio analysis and proposal generation, AI-powered tools are empowering advisors to streamline their operations, enhance client service, and unlock new growth opportunities.

As the role of AI for financial advisors continues to evolve, we firmly believe that those who embrace AI responsibly and integrate it into their daily workflows will be well-positioned to thrive in the face of increasing competition and shifting client expectations.

If you're ready to take your financial advisory practice to the next level, now is the time to explore the potential of AI. Whether you're looking to streamline your prospect-to-client conversion process or simply free up more time to focus on high-value client interactions, Advisor Core can help you achieve your goals. Visit our website or schedule a demo today to discover how Advisor Core can transform your practice through personalized experiences and some AI magic.

About the Author

About the Author

Gabe Rissman is the President and Co-Founder of YourStake. He has a background in data science and AI and holds a B.S. in Computational Astrophysics from Yale. Gabe is a WealthManagement.com 2022 Ten to Watch, is a

board member of the Intentional Endowments Network, is

a member of the Adasina Social Justice Index Committee, and was named 30 under 30 in Socially Responsible Investing.

Share this

- Road to Launch with XYPN Member Alan Skillern, CFP®, MBA

- Coaching for Better Time Management: Prioritizing Organic Growth in Your Daily Routine

- Boost Your Financial Advisory Practice: SEO Strategies and CRM Optimization for Sales Success

- Navigating the AI Revolution: What Financial Advisors Need to Know

- Advisor Blog (692)

- Financial Advisors (221)

- Growing an RIA (99)

- Digital Marketing (87)

- Marketing (84)

- Community (81)

- Start an RIA (76)

- Coaching (72)

- Business Development (71)

- Running an RIA (70)

- Compliance (69)

- Client Acquisition (65)

- Technology (64)

- XYPN LIVE (59)

- Entrepreneurship (56)

- Sales (49)

- Practice Management (44)

- Client Engagement (41)

- XYPN Books (38)

- Bookkeeping (37)

- Investment Management (37)

- Fee-only advisor (36)

- Lifestyle, Family, & Personal Finance (31)

- Employee Engagement (30)

- Client Services (25)

- Financial Education & Resources (24)

- Journey Makers (21)

- Market Trends (21)

- Process (14)

- Niche (11)

- SEO (9)

- Scaling an RIA (9)

- Career Change (8)

- Transitioning Your Business (7)

- Partnership (6)

- Transitioning To Fee-Only (4)

- Social Media (3)

- Transitioning Clients (3)

- Emerald (2)

- Persona (2)

- RIA (2)

- Onboarding (1)

- Sapphire (1)

Subscribe by email

You May Also Like

These Related Stories

Meet Holistiplan, Winner of Our 2019 FinTech Competition

Sep 26, 2019

2 min read

Part II: The Changing College Planning Paradigm: Implications and Opportunities for Financial Advisors

Jun 12, 2017

4 min read