RIA SEO: Keyword Strategies for Financial Planners

Share this

If you’ve found this blog from a Google search, then you’re in the right place.

SEO might be one of the most daunting marketing acronyms you’ll come across. SEO for financial advisors can be even more complex. Likely you’re a financial advisor and business person first and a marketer second, which is why the thought of learning a whole new field of expertise might make you hesitate. Don’t worry, you’re not alone. I’m XYPN’s resident SEO nerd, and I’m here to help you get started. A strong SEO strategy is built around the right keywords that are relevant to your RIA, and I’m going to walk you through selecting and using them.

What is SEO at its core?

Search engine optimization (SEO) is the process of making the written words, images, videos, and structure of your site easy for search engines to crawl and understand. Google, for example, will take a look at the text on all of your pages and determine what subject you’re an authority on, and just how authoritative you are. It uses a few important signals to decide this, but for the purpose of this article, we’re going to focus on keywords.

How do I select the right keywords for a financial planner?

You can have the most relevant content on the web, but without the right keywords, the right customers may never see it. It’s important to know what people search for, and how they search for it, and try to create your website content with those things in mind.

Keyword research is complex, but probably one of the most concrete areas of SEO. This is where you use all the data at your disposal to find the right keywords and phrases that your customers would type into a search engine. Put yourself in the shoes of your ideal customer, and say to yourself “how would this person type out a Google search for my services?” Boom. That's your keyword. Sounds easy, right? Well, there’s a little more to it than that when it comes to advisor search engine optimization.

Google has access to an intense amount of search data. You can use free SEO tools like Google Keyword Planner or Moz Keyword Explorer to see just how people phrase searches, and how many of them. We’re big fans of SEMRush here at XYPN, but for the price, you might want to start out with something a little more cost-effective if you’re just getting started with SEO. Pick your SEO weapon of choice, and start plugging in phrases you think might have some power. If you want a wider view of the SEO tools for financial advisors, here are our favs:

Free keyword tools for getting your RIA website up and running

- Google Ads Keyword planner is a free option for finding basic keyword search volumes and competitive pricing for ad-related searches. I recommend everyone start here and then evaluate if you need to spend more for functionality you’re missing out on.

- MOZ SEO has a very basic free plan, but it’s a great place to start. When you get into their paid tiers, you get access to track your ranking over time, more tracked keywords, page SEO audits, and more!

- Keyword Surfer has a free trial that can get you the insights you’ll need to devise a keyword strategy. I recommend using this if all you need is to get up and running.

Paid SEO tools for growing your RIA’s content marketing strategy

- Ahrefs is a wonderful tool if you’re looking to create content on the regular and grow your influence amongst different niches. If you’re going to focus on a content strategy, this tool can help you zero in on the right keywords to support growth.

- SEMRush is the Swiss army knife of SEO tools and a content-creators best friend. From keyword data to site audits and more, SEMRush has more tools than you’ll know how to use. Not only one of the best SEO tools for finance, but any industry. I can't speak highly enough about SEMRush.

Keep in mind that spending money on a premium tool doesn’t guarantee results, so it’s best to start small until you’re more comfortable with the tools at hand. That being said, once you have your tool of choice, it’s time to start keyword research!

You’ll need to get creative here and really experiment with different phrases to find the real data. It's common practice to have about 5-10 keywords that perform strongly for your niche. Some examples might include:

- “[Niche] financial advisor”

- “[Niche] estate planning”

- “Financial advice for [niche]”

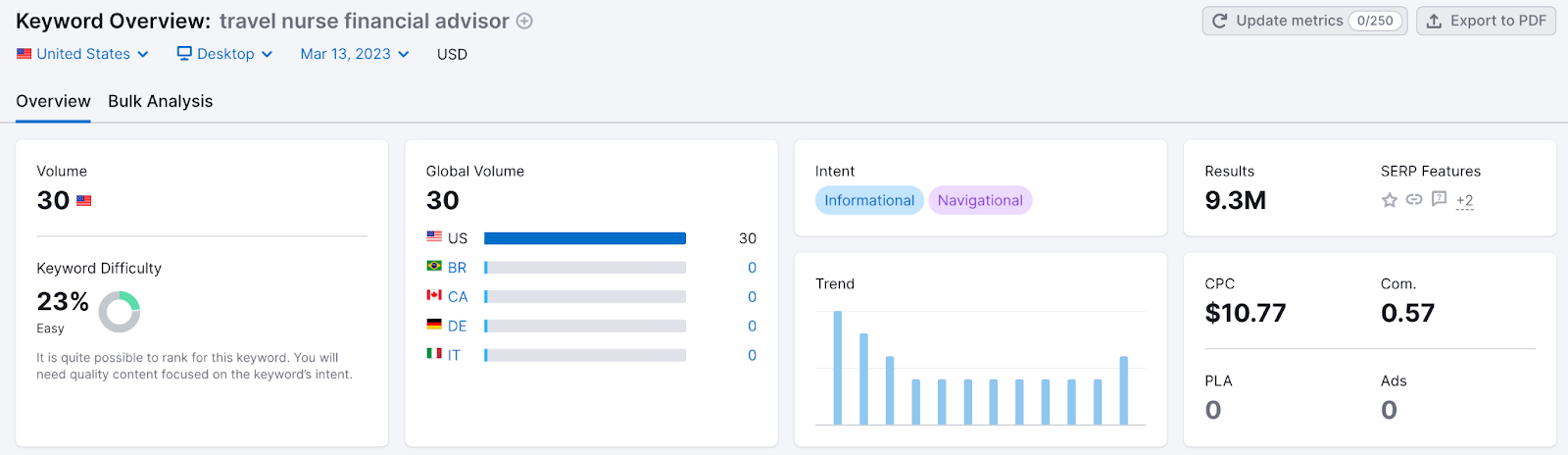

I’ve entered “Travel nurse financial advisor” in SEMRush to show you an example of what to look for. All of the stats and metrics below are useful in helping a financial advisor who specializes in helping travel nurses optimize for that audience, and I’m going to explain them in a little greater detail.

- Volume is the average number of searches per month for the given phrase. The higher the volume, the better.

- Keyword Difficulty is the percentage of difficulty you'll have ranking highly against other site optimizing for this search phrase. The lower the score, the better.

- Global Volume tells you where in the world these searches are coming from.

- Intent shows you if these searches are related to you. Informational searches are from users that want answers to specific questions. Navigational searches are for users looking for a specific page or site.

- Trend shows you the interest in this phrase over time.

- Results show you how many pages rank for this keyword overall.

- SERP Features are any results that display that are not “traditional” search engine results page (SERP) results. These can be in the form of reviews, site links, or “People also ask” results.

- CPC is the average “Cost per click” that advertisers will pay to rank in ads for this keyword.

- Com. is the competitive analysis of the keyword against other sites that are paying to rank in ad results for that keyword.

For the purposes of SEO on your RIA’s website, I strongly suggest you focus on volume and keyword difficulty to make the bulk of your keyword decisions.

"But what if there is very little or no volume for the phrases I’m researching?"

This isn’t necessarily a problem. If you’re specializing in a niche (we’re big on niches here at XYPN), then you’re likely not going to have an abundance of volume. In this case, any volume is better than no volume at all. It also means you have a higher chance of being one of the top search results when the right user types in that magic phrase.

"What if all my keywords have high volume, but high difficulty?"

You’re not alone. Use these keywords as a starting point to narrow down your keywords to specific long-tailed phrases that are hyper-relevant to your RIA. Translation: see smoke, and find the fire.

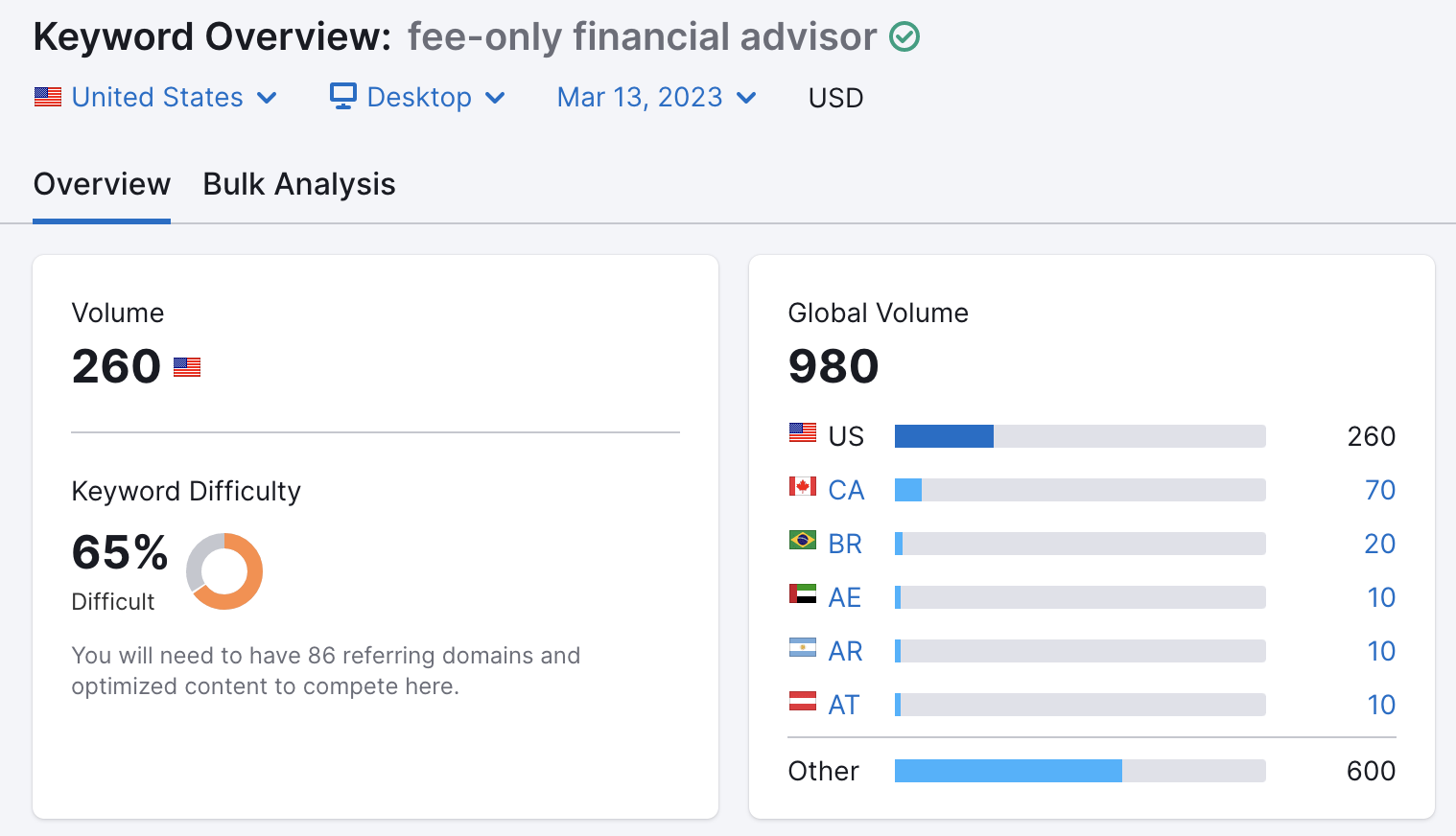

Here’s an example where I typed in Fee-only financial advisor

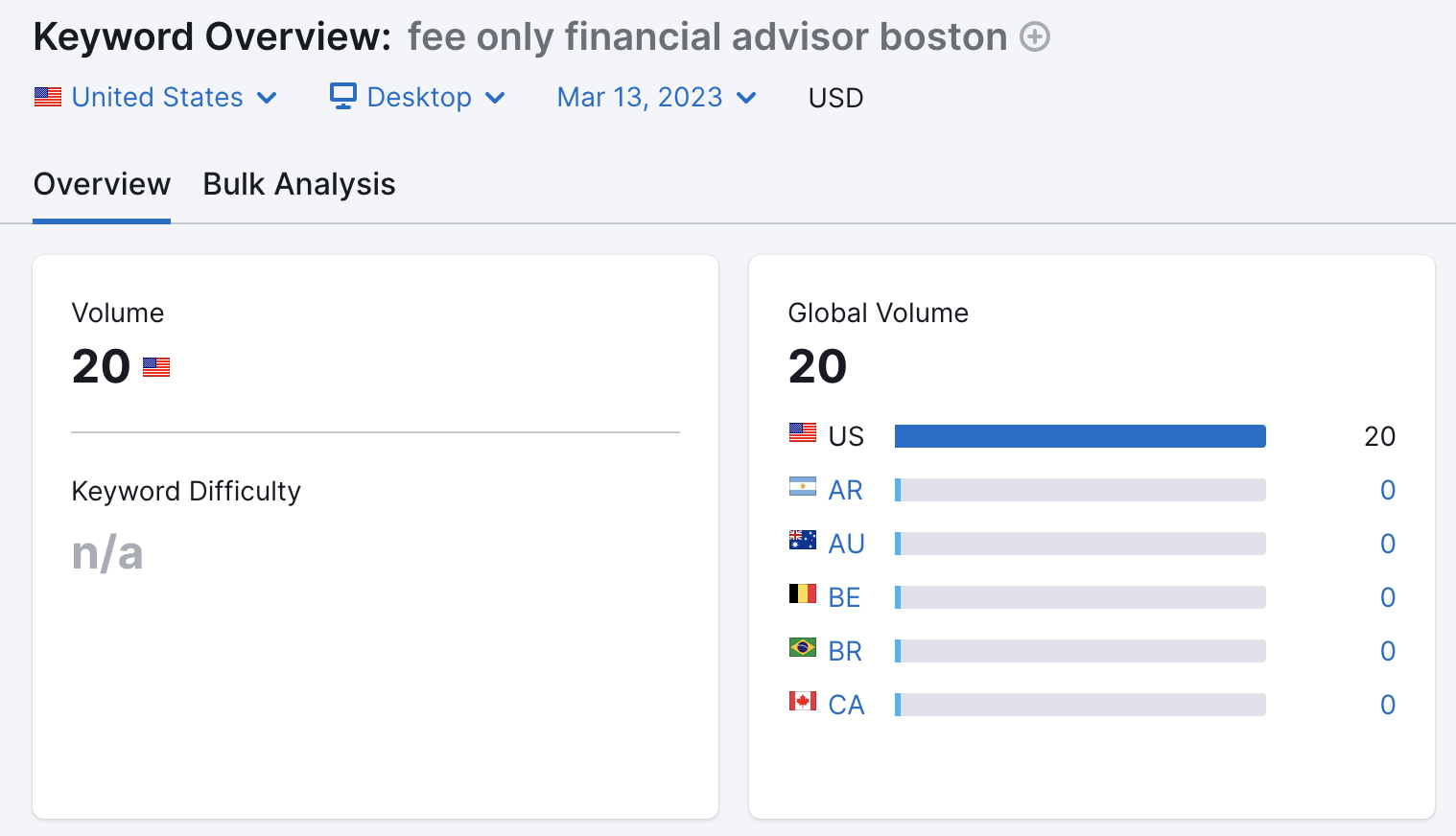

You’re going to have a harder time reaching the first page of a Google search result with a 65% difficulty score. You can use add-on keywords to narrow down and refine these numbers. Look at what happens when we add a city name to the end of the phrase. It might only be 20 searches per month, but you can virtually own that phrase and all 20 searchers get a better chance to find and visit your site.

Low search volumes are an important reason why you need to optimize for multiple keywords. It's better to SEO 10 keywords with marginal search volume that your RIA ranks highly for than to have 3 keywords with high search volume that you hardly rank for at all.

SEO Keywords for financial advisors: putting your phrases to work

You might look at the above title and think: “that’s a funny way to write it.” You’re right. But what I’ve done, is taken one of the keywords that I’ve identified as hyper-relevant to you the reader, and added it to a title in this blog. Here’s why this is important. You want to optimize your content using the keywords as close to the actual search phase as possible. Obviously, it’s not a good experience to stuff your blogs and pages full of phrases that read weirdly. The reader might know what you’re up to. I simply took advantage of the fact that this article is about SEO to craft the H2 above. Now that I’ve established that, let's look at the best ways to structure your keywords on any given page.

Add your strongest keywords to your meta titles and descriptions

The title of your page should have your keyword in it. This is one of the strongest signals to search engines that you’re an authority on the topic. You should also add the keyword to your short, 140-character description of the page. Think of this as a -2 punch: when a user searches for your keyword, your result will come up and the description will show them that your link is the one they need to click on.

Add keywords to header tagsCertain titles throughout your copy will have meta tags, which essentially convey to a search engine crawler that your page has an overall structure. H1’s (Header 1) are usually the topmost title on a site page or blog. They’re larger text than the rest and they should be high level. H2’s are the second tier down. The weirdly written title for this section of the article is tagged as an H2. Depending on the content of your page, you can tag titles all the way down to an H6. Most articles and pages will use 1-4.

Adding keywords to these tags is an important signal to search engine crawlers that your page is authoritative on the topic, and that you have an easy-to-read page. Google wants to recommend only the most relevant content to the user, so you have to play by their rules and defer to their preferences.

Sprinkle keywords throughout your paragraph text.

“Paragraph” is another tag that websites use to denote the general copy. You want to add your keywords into the body of your page copy at a reasonable amount. Adding keywords too many times can signal to search engines that you’ve “keyword-stuffed” your page, and can actually work against you. The rule of thumb, according to HubSpot, is to use 1-2 keywords per 100 words of copy. If you stick to this, you shouldn’t have to worry about any penalties.

Another rule of thumb is to try and write longer blogs. Typically 800+ word blogs perform the best. The more words on the page, the better chance you have to show search engines that you’re an authority on your topic.

Measure your resultsYou’ve implemented your keywords. So how do you know if it’s working? To get answers to this, you’ll turn to Google Analytics (GA). If you haven’t set up a Google Analytics account, you’ll want to go through this process to add it to your site. This is a powerful, free tool to help you get better insights into your traffic. Success with your keyword strategy will correlate with the amount of “organic” traffic that you measure in GA.

When you’re in your dashboard in GA, go to Acquisition > All traffic > Channels to see how much organic traffic you’re receiving from search engines. You want to measure this over time. Your number of users increasing means that more folks are finding your site. Your AVG time on page increasing and pages/session indicate the users are finding your content relevant and interesting. Your bounce rate is the percentage of users that come to your site and take no action at all, so you want to see this percentage decrease over time.

A good keyword strategy won’t increase your traffic overnight, but if you keep creating relevant optimized content, this will help you increase your overall ranking. The above metrics are all great ways to indicate your strategy is working.

Breaking the 4th wall: financial advisor SEO

As I said in the beginning if you found this article via Google search, it’s no accident. I wrote this blog because keywords are an important and overlooked aspect of financial advisor search engine marketing. I spent a lot of time chatting with XYPN members at XYPN LIVE last year about SEO, marketing, and how to develop a keyword strategy. Most importantly, I chose a topic I knew was important to my audience. I want nothing more than for every single one of our members’ firms to flourish, and the right keyword set will make this entirely easier. So I wanted to show you exactly how I planned this blog with keywords in mind.

I figured out who I'm writing to:

My goal was to reach you because you’re looking for advice on how to tackle your SEO. You’re looking for a trusted resource that is relevant to financial planners, and whether you know it or not, XYPN has some of the best resources for fee-only financial advisors.

I figured out what you’d search for:

No surprise, I chose keywords that made sense and had data. I spent about half an hour making sure that I had 3-5 super relevant keywords for this article that would show Google I was the best match for your search. Here’s what I used:

- Marketing for financial advisors

- RIA marketing

- RIA Marketing plans

- SEO for financial advisors

- Financial planner SEO

I used a few more than that, but I started with those in mind. By writing with the keywords in mind, most of the SEO came pretty naturally in this article.

I wrote to convey and convert:

Some of the areas of this might have been a little deep for you, and I get that. But wouldn’t you rather read a blog that showed authority and deep knowledge of SEO, than a blog that hit a few high-level points and linked off to its sources? My goal is to give you the value you were looking for in the fewest amount of clicks possible. Hopefully, I’ve done that.

As for the conversion part, my overall goal is to offer you a resource that we’ve spent a lot of time creating that will truly add value to your marketing plan. We created a marketing funnel template that you can download to start planning out how you’re going to market your financial planning firm effectively to the right potential clients.

If I’ve helped you at all with this article, then it’s worth taking the next step and planning out your overall strategy using the above template. You’re sure to have questions, and we’re here to help. Make sure to subscribe to our blog so we can keep you up-to-date on all things RIA marketing, among other topics you’re sure to find value in.

About Sam McCue

Sam McCue is XYPN's Director of Sales & Marketing Operations. He specializes in all things SEO, marketing strategy, and automation.

Share this

- Advisor Blog (723)

- Financial Advisors (245)

- Growing an RIA (128)

- Business Development (97)

- Digital Marketing (96)

- Marketing (93)

- Community (82)

- Start an RIA (76)

- Coaching (75)

- Running an RIA (72)

- Compliance (71)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (49)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- XYPN Books (43)

- Scaling an RIA (42)

- Investment Management (41)

- Financial Education & Resources (32)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (27)

- Journey Makers (25)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Sapphire (7)

- Transitioning Your Business (7)

- Persona (4)

- Transitioning To Fee-Only (4)

- Emerald (3)

- Social Media (3)

- Transitioning Clients (3)

- Onboarding (2)

- RIA (2)

- Transitioning to a Corporate RIA Affiliation (1)

Subscribe by email

You May Also Like

These Related Stories

Financial Planning SEO: How to Help Your Niche Find You

Jan 22, 2024

5 min read

Boost Your Financial Advisory Practice: SEO Strategies and CRM Optimization for Sales Success

Mar 31, 2025

5 min read

.png?width=600&height=400&name=PW%20%20Insider%20Insights%20YT%20Thumbnail%20Image%201920%20%C3%97%201080%20px%20(1).png)