Maintaining a Growth Mentality During a Financial Crisis: Changes You Can Make Now in Your Practice

Share this

If you’re familiar with XYPN’s culture and business model, you know we thrive on a mentality of abundance, not scarcity. One of the cornerstones of our Network is a community of financial advisors who share ideas, strategies, and successes to help one another run and grow their businesses. These advisors focus on the benefits gained from sharing resources and information rather than viewing other advisors as a threat to their slice of the market.

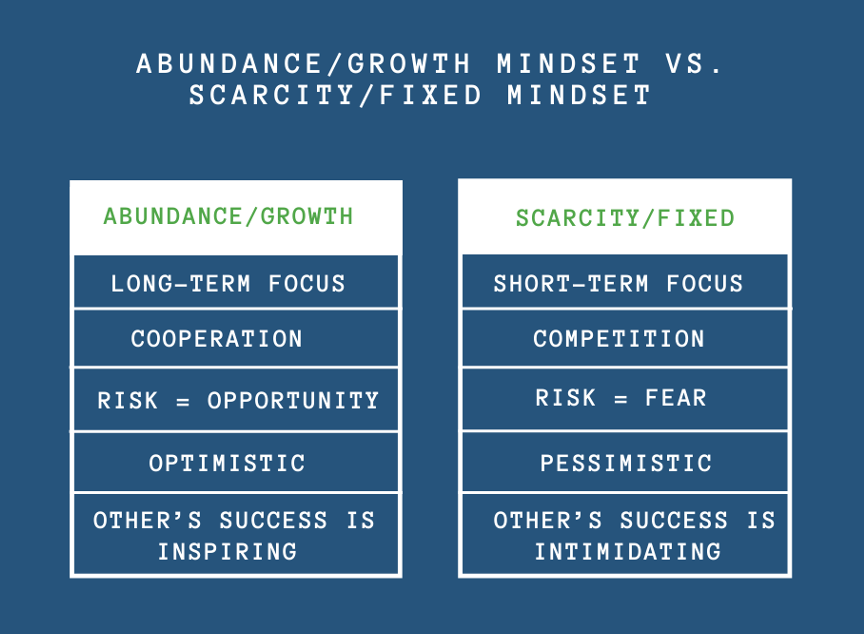

Abundance vs. Scarcity Mindset

First, let’s briefly review the difference between an abundance mindset and a scarcity mindset.

In general terms, an abundance mindset focuses on the idea that resources are unlimited, there’s more than enough to go around (whether it’s money, opportunities, time, etc.), and that you can get enough of what you need without someone else losing out.

In contrast, the scarcity mindset is based in fear—fear that someone else’s gain is your loss, fear that resources will run out, and ultimately fear of risk and change as a result.

This is closely related to the difference between a “growth mindset” and a “fixed mindset,” terms defined by researcher Carla Dweck, author of Mindset: The New Psychology of Success. Growth mindset, often linked to success and positive transformation, takes the positive view that it’s possible become smarter, richer, happier, and more successful (in other words, that those traits are abundant and attainable in the world), while those in a fixed mindset focus more on the status quo, believing in that their current situation will remain the same (and, more globally, that the amount of resources available are fixed and static). Based on this research, the fixed/scarcity vs. growth/abundance dichotomy is not only about the sense of wellbeing that results from focusing on possibilities rather than limitations, it is directly tied to personal and professional success.

Many financial planners address the difference between these two mindsets with their clients. You may have coached your clients to adopt an abundance mentality and noticed the problems that arise with your clients who focus on scarcity.

For example, your scarcity-focused clients may spend their paychecks immediately rather than saving appropriately because they believe that you should spend money as soon as possible when you have the opportunity. This reflects the attitude that you need to take advantage of any and all resources as soon as they become available, because they won’t always be.

On the opposite side of the spending spectrum, a scarcity mindset can also be related to major risk aversion. While your clients may generally demonstrate varying degrees of risk tolerance, you may have noticed that your scarcity-focused clients have little to no tolerance. The thinking here is hanging onto every penny rather than taking advantage of a calculated risk feels safer and more secure. These clients may frequently miss opportunities because they are so focused on what they might lose rather than potential gains. (These are the clients who immediately call you when they see that their retirement fund has taken a hit and ask to put the money into a “safer” investment.)

As you can see, the difference between these two mentalities often centers on short-term vs. long-term thinking. As an advisor, you know that taking the long view will help clients reap huge benefits down the road. But a client who thinks of money as scarce and hard to come by is thinking only about immediate needs and expenses.

The current financial environment has resulted in a lot of stress and worry, making it harder for many clients and advisors alike to feel like money and resources are abundant. If you’re struggling to stay afloat—and even if you’re not—this is a critical time to focus on opportunities and possibilities. It’s a time for creative thinking, so you can maintain a healthy and thriving practice to serve your clients.

How to Promote a Mentality of Abundance and Growth in Your Firm

So how do you bring this way of thinking to life within your firm? I’ve outlined several ideas you can focus on right away to begin moving toward a mentality of abundance.

Network and Share

At XYPN, we believe that being part of a thriving and supportive community is one of the keys to advisor success at every step of your firm’s journey. XYPN advisors share ideas and resources through our member forums and connect through study groups and frequent member meetups (now virtual). Ideas and support flow freely from our advisors, which adds to each individual member’s success.

This is the time to be seeking out the support of others in the industry and to offer help to other advisors if you can. Share resources and ideas, and network as much as possible. You can do this through industry membership organizations such as XY Planning Network, NAPFA, FPA or through local groups.

For more on this topic, I recommend XYPN Executive Business Coach Arlene Moss’s article How to Choose a Support Network as an Independent Financial Advisor.

Take Your Own Advice

As you’ve likely coached your clients on the topic of abundance versus scarcity, I’d recommend that you use some of this advice in your own firm.

Many of your clients may be open to new ideas about managing their finances but are stuck in patterns that aren't working. Are there new business strategies you can try that you haven't before? If business is slow, maybe this is the time to rethink your sales, marketing, and pricing strategies. Maybe your website could use an overhaul. For more on this topic, I recommend an article from our team: Navigating the New Normal: Strategies for Serving Your Prospects and Clients.

When meeting with prospects, you likely emphasize the long-term benefits of financial planning to justify short term costs. And when creating a client financial plan, you build in strategies for protecting your clients’ wealth and resources against market fluctuations over time. But are you also taking a long-term approach in your practice? Make sure any decisions or changes you make will benefit your firm in the long run and are not simply designed to mitigate any immediate pressure.

Pick a Niche Already!

Selecting a niche focus seems scary for a lot of advisors. Many wonder why they would narrow the prospect pool and cut out lots of potential clients. But if you consider the thinking behind this fear, you’ll notice that it’s based in a scarcity mentality. Not choosing a niche is a way of saying, “I’m afraid there aren’t enough clients to go around, so I’m going to make myself available to everyone.”

If you haven't yet, this is the time to establish a niche focus. And for those of you who do have an established niche, make sure your marketing efforts are focused on how you can be of service to your target market specifically.

As tempting as it may be, avoid the urge to cast a wider net to desperately capture anyone and everyone; instead emphasize the benefits of specific services you can provide for your target market. This was emphasized in a recent Daily Briefing call for XYPN members as part of our recession preparedness program, The Way Forward; during the call, XYPN co-founder Michael Kitces described how compelling it can be to provide targeted solutions for your prospects and clients based on their specific needs.

Kitces provided an example of an advisor serving optometrists who presented an informational webinar focused on how those who own an optometric business can navigate current challenges such as the CARES Act, the Paycheck Protection Program, and potential write-offs specific to optometrists.

If you think about this from the client perspective, there’s no way you’d select an advisor who advertises serving “business owners” when given the opportunity to work with an advisor who works exclusively with those who own businesses in your industry and who can provide specialized and targeted planning advice. (If you’re wondering how the webinar was received, Kitces mentioned that the advisor addressed a group of 700 prospects and now has a waiting list.)

We know this is a tough time for a lot of advisors, and the current global reality is inevitably going to cause tangible personal and financial losses for all of us, either directly or indirectly. But I believe that the way XYPN membership is focused on supporting both clients and fellow advisors demonstrates the power of a cooperative, optimistic, and growth-minded approach.

For more on this topic, I recommend the following resources:

- Michael Kitces’s article Financial Planning and Building An Advisory Firm With An Abundance vs Scarcity Mindset

- Kitces & Carl Ep 30: Conveying Rational Overconfidence In Talking To Clients About Coronavirus Fears

About the Author

Kate Ross has spent the last ten years of her career developing educational materials for financial professionals and brings a passion for instructional design and curriculum development to the XYPN team.

In her free time, Kate can be found front row at a concert, camping in the woods, floating a river, or hiking in the mountains near her home in Montana.

Share this

- Running Your RIA Efficiently: Outsourcing Bookkeeping with XYPN Books

- Road to Launch with XYPN Member Alan Skillern, CFP®, MBA

- Coaching for Better Time Management: Prioritizing Organic Growth in Your Daily Routine

- Boost Your Financial Advisory Practice: SEO Strategies and CRM Optimization for Sales Success

- Advisor Blog (693)

- Financial Advisors (221)

- Growing an RIA (99)

- Digital Marketing (87)

- Marketing (84)

- Community (81)

- Start an RIA (76)

- Business Development (72)

- Coaching (72)

- Running an RIA (70)

- Compliance (69)

- Client Acquisition (65)

- Technology (64)

- XYPN LIVE (59)

- Entrepreneurship (57)

- Sales (49)

- Practice Management (44)

- Client Engagement (41)

- Bookkeeping (38)

- XYPN Books (38)

- Investment Management (37)

- Fee-only advisor (36)

- Lifestyle, Family, & Personal Finance (31)

- Employee Engagement (30)

- Client Services (25)

- Financial Education & Resources (25)

- Journey Makers (21)

- Market Trends (21)

- Process (14)

- Niche (11)

- SEO (9)

- Scaling an RIA (9)

- Career Change (8)

- Transitioning Your Business (7)

- Partnership (6)

- Transitioning To Fee-Only (4)

- Social Media (3)

- Transitioning Clients (3)

- Emerald (2)

- Persona (2)

- RIA (2)

- Onboarding (1)

- Sapphire (1)

Subscribe by email

You May Also Like

These Related Stories

8 Questions to Help You Choose Your Niche as a Fee-Only Advisor:

Oct 25, 2021

9 min read

How Can XYPN Membership Benefit Established Advisors?

Sep 13, 2021

10 min read