Follow the NFL’s Lead and Give Your Clients an "Offensive" Experience

Share this

There’s a major trend in a lot of sports right now, and it's extremely prevalent in the NFL in particular. And no, I’m not talking about player safety, although that is a close second.

It’s the trend toward making the NFL a more “offensive” game.

You see, the NFL, like all major sports, is here to make money. Everyone loves winning, of course, but you know what else people like? Making money. And that’s what the NFL owners really care about. (Trust me, as a lifelong Dallas Cowboys fan, Jerry likes his money more than he likes Super Bowl trophies.)

The problem is they are competing for entertainment value at an unprecedented level. If a game is not a rip-roaring, launch you out of your seat thriller, people tune out. Game over.

The NFL has figured out that people like offense. They like to see teams score. They like to see Aaron Rodgers launch a football 50 yards with the flick of his wrist. They like to watch Odell Beckham Jr.’s one-handed grabs on repeat. People like 38-35 finishes with overtime...as long as they don’t finish in a tie.

You know what people don’t like? Defense. Handing the ball to a running back only to watch him crash into a wall of people for a tiny 4-yard gain.

Defense may win championships, but it doesn’t get ratings. The NFL has literally changed the rules of their sport to favor a more “offensive” brand of football.

And you should too.

Take a Cue from the NFL’s Playbook

Want to get more people in “your seats”? Want more engaging conversations with clients? Start talking offense!

But what exactly is “offense” for a financial planner?

Let’s think about this for a second. A good offense is simply moving the ball down the field, usually at a pretty good pace, and in the end...SCORE!

For clients, this means addressing the reason(s) they came to you in the first place. It means checking things off the list. It means making progress now, not just in the future. It’s not just being prepared, it’s about feeling the sense of accomplishment—it’s about winning. Your clients should leave their conversation with you feeling that together you have, in the very least, moved the ball very far down the field.

As planners, so much of what we do is future-related. It’s largely about preparation. But it can be hard to feel a sense of accomplishment in the preparation. It’s akin to a diet or working out. The results are not automatic. You see them slowly, over time. That’s why so many people feel discouraged early on in a diet or new workout regime.

A good offense puts points on the board.

Offense for Instant Gratification

Why are the FAANGs (Facebook, Amazon, Apple, Netflix, and Google) so popular?

They all offer instant gratification. One click. Buy. Share. Watch.

Pause for a second and examine your client experience.

Where and how do you offer instant gratification?

Most prospects come to us with a problem they want solved. Something—and by that I mean some THING—caused them to take action and seek you out.

As comprehensive financial planners, we like to take a holistic approach and look at the entire picture. There’s nothing wrong with that. In fact, when most people understand what it is you offer, they appreciate this holistic approach.

But you can’t get lost in the big picture and neglect the “some THING” they came to you about in the first place. While being comprehensive is great, remember to address the one thing they came to you for right away.

The Financial Planning Wheel of Death

Look familiar? Yup, that’s the good old financial planning process graphic we’ve all seen. We all have them in some form or fashion.

Do you know what a prospect or client who sees this thinks? “Wow this looks like a lot of work and it will be a long time before I see any progress.”

Remember the FAANGs? This is what their process looks like:

To compete today, we need to offer more instant gratification to our prospects and clients. That’s not to say we don’t take a long view, but value must be present at every interaction.

Here are some tips to provide instant gratification to your prospects and clients:

- Don’t let your process impede progress

If the prospect came to you for help with college planning, but it’s Step Four in your process, skip to Step Four. Don’t let the “Planning Wheel of Death” get in the way of quick progress.

- Make it EASY to become a client

If you are working your niche properly and if the data holds true that most people have “touched” you and/or your content almost 20 times before actually making contact, chances are your prospects have a pretty good idea what you’re all about when they’ve finally contacted you.

Be prepared in your first interaction to convert the prospect to a client. Have paperwork ready. Send them information on how to be prepared prior to the interaction. Let them know ahead of time what to expect and give them enough information to make a decision on the spot.

- Don’t send them down the road

This is a major pet peeve of mine. And yes, I’m admittedly biased. But, if you have the ability and capacity to solve a client’s problem, SOLVE IT. Don’t send them down the road for implementation. It’s the old dentist analogy. You go to the dentist because your tooth hurts. You get in the chair, the dentist comes in and says, “Why yes, you have a cavity. But I’m a fee-only dentist with no conflicts of interest. This way I don’t have any incentive to find more cavities that you actually have. Isn’t that great!” Now you can go down the road and get the cavity fixed somewhere else because guess what? Your tooth still hurts.

- Be sure they leave with value

Don’t be afraid of “giving away too much for free.” We live by the abundance mentality at XYPN. No harm ever comes by giving away value. You don’t have to give away the farm, but time is one thing that’s very hard to get more of. If people are spending their time with you, make it worth it.

One of the new client experience trends for advisors is helping clients understand their money biases. This is a tremendous value add that is easy, cheap, and valuable. Almost every client who goes through the exercise finds value. Apps like DataPoints and ROL Advisor allow people to understand their money biases or attitudes, which in turn leads to better decision-making.

- Figure out what your prospects want right out of the gate

Don’t be afraid to ask your prospects what they want. Ask questions like:

If we could accomplish one thing today, what would it be?

When you leave here today, what would you like to leave knowing?

What would make you feel like this engagement was worth your time?

- Take “yes” for an answer

Enough said.

Know Your Competition

Who is your competition? Actually, the better question is what is your competition? In many cases, it’s not actually other advisors. Like most other businesses, our main competitor is the other “stuff” people want to do with their money and time.

Want to work with GenX H.E.N.R.Y.s who have two kids, a dual-income, a mortgage, some student loans, and who spend Saturdays at Costco and the soccer fields? Send them everything ahead of time via dashboard and let them know your meetings are in 15-minute quick hit increments via web conference, saving them time, a babysitter, and the headache of trying to find “your” office in that co-work space. SCORE!

Want to really crush your competition? Help your clients get that “stuff” you’re competing with. What does that mean? Think of it this way. If we are competing for our clients’ attention and hard-earned money, help them do the things they want to spend their attention and money on in the short term. Yes, we need to help with the long-term aspects too but clients need wins, especially early on.

Think of your competition as Disneyland. That’s whom you are actually competing with for your clients’ attention. How much does it cost to work with you? A trip to Disneyland perhaps? Sell clients on a secure, long-term future, but also sell them on the fact that you can help them get to Disneyland.

Planning for the Best

Planning for the best? No. We are planners. Our job is to look for the blind spots, to be risk averse, to help our clients who can’t help themselves. Sure we like to talk about “goals and dreams” and things like “aspirations,” but the reality is that by nature, the majority of planners and advisors tend to be more prone to protection and have a bias towards fear.

We are prone to saving, may be apprehensive about taking risks, and sometimes just need things to be all buttoned up before we can feel good about it all. We are careful and meticulous with our planning, we like to be prepared for bad outcomes and we like a high degree of certainty when we make decisions.

Now hear this…

Not everyone is like that! Not everyone needs an “85% probability of success” to feel good about their decisions. Not everyone cares that you want them to be secure to live to 110 because you “like to be conservative” and you “don’t take chances” with your clients hard-earned money.

Sometimes clients need to feel like they have accomplished something rather than avoided disaster.

We all need to be prepared and keep an eye out for our client’s blind spots, and in many cases what’s directly in front of their faces.

But too many advisors let their own fear and their own sense of conservatism reflect back on to their clients. And it’s killing your clients’ financial lives and the growth of your firm.

The Best Way to Play Offense—More Goals

Recently, MoneyGuidePro did an analysis of all the plans in their database and found that on average, each plan had approximately two goals. TWO GOALS! So much for all that talk about hopes, dreams, and aspirations.

If you want to get and keep clients engaged, talk about their wants, needs, wishes...their nows, nexts, and laters.

Offense = GOALS.

Your clients should have a range of goals and a lot of them (certainly more than two!). And while we are on the subject, retirement doesn’t count as one of them.

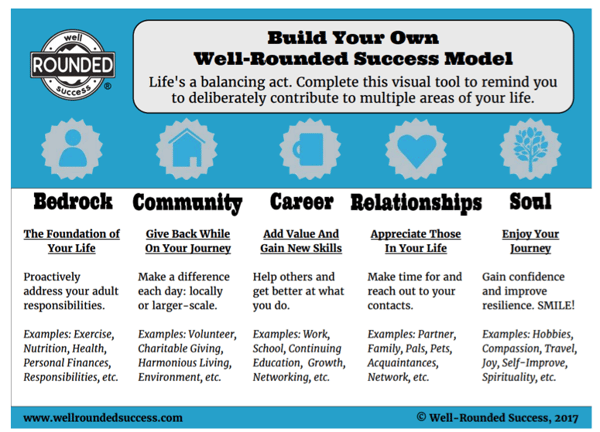

Make their goals interactive. Make them intentional. And yes, make them aspirational. They don’t all need to have monetary value either. I love what XYPN member Dan Andrews (@WRSuccess) has done with his “plan” to help with multiple levels and areas of his clients’ lives. SCORE!

Know Thyself

Grab a mirror. What do you see? (Disregard the newly formed wrinkles and hints of gray caused by this crazy adventure you’re on—it’s all worth it, trust me.)

It should go without saying that we need to know ourselves—and especially our own biases—so we can help our clients navigate theirs. It makes perfect sense, but then again, it can be challenging to look inward.

Here’s the good news. Self-awareness is all the rage right now. It’s what the cool kids are doing. Your ability to have a conversation—first with yourself and then with your clients—about your own biases will help them be more informed and speak more clearly about theirs.

If you struggle to get “offensive” or “plan for the best,” that’s okay. Just remember, there’s a life happening right now, today, that needs your help.

Defense wins championships and your clients need you for that. But if you don’t have the offensive game to compete, you won’t be around for the long run.

About the Author

A creative innovator and collaborator, Brandon Moss has had a front-row seat to the digital advice revolution, helping build one of the most innovative national RIAs on the planet. He’s acquired a 360* view of the RIA landscape, from being an advisor and running his own firm to designing and integrating some of the most innovative tools in the industry. He has lead, trained, coached, onboarded, integrated, transitioned, (you name it) over 100 RIA firms/wealth management teams. Additionally, he's evaluated, prospected, pitched (again...you name it) countless other firms. Consequently, he's an exceptional listener and comfortable in many different conversations! Occasionally, he's asked to opine on varying topics, typically Gen X+Y, innovation, client experience and technology. Beyond those topics, he's typically “winging it”. Brandon graduated from Texas Tech University's globally recognized personal financial planning program, then made it through some Executive Education at UC Berkeley's Haas School of Business. He’s also perpetually in online classes trying to figure out something new. Brandon resides in the Dallas/Ft. Worth area with his wife, Shelby, and his identical, mirror-image twin boys, Will and Reese. When he's not with them, he's probably in his garage tinkering, building, or buying way too much golf equipment.

Brandon is the Director of XY Investment Solutions (XYIS), XY Planning Network’s digital hybrid investment platform. It’s a turnkey asset management platform (TAMP) designed and curated to the specific needs of XYPN members.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Running Your RIA Efficiently: Outsourcing Bookkeeping with XYPN Books

- Road to Launch with XYPN Member Alan Skillern, CFP®, MBA

- Coaching for Better Time Management: Prioritizing Organic Growth in Your Daily Routine

- Boost Your Financial Advisory Practice: SEO Strategies and CRM Optimization for Sales Success

- Advisor Blog (693)

- Financial Advisors (221)

- Growing an RIA (99)

- Digital Marketing (87)

- Marketing (84)

- Community (81)

- Start an RIA (76)

- Business Development (72)

- Coaching (72)

- Running an RIA (70)

- Compliance (69)

- Client Acquisition (65)

- Technology (64)

- XYPN LIVE (59)

- Entrepreneurship (57)

- Sales (49)

- Practice Management (44)

- Client Engagement (41)

- Bookkeeping (38)

- XYPN Books (38)

- Investment Management (37)

- Fee-only advisor (36)

- Lifestyle, Family, & Personal Finance (31)

- Employee Engagement (30)

- Client Services (25)

- Financial Education & Resources (25)

- Journey Makers (21)

- Market Trends (21)

- Process (14)

- Niche (11)

- SEO (9)

- Scaling an RIA (9)

- Career Change (8)

- Transitioning Your Business (7)

- Partnership (6)

- Transitioning To Fee-Only (4)

- Social Media (3)

- Transitioning Clients (3)

- Emerald (2)

- Persona (2)

- RIA (2)

- Onboarding (1)

- Sapphire (1)

Subscribe by email

You May Also Like

These Related Stories

How to Inspire Your Clients to Action and Help Them Achieve Financial Freedom with George Kinder

Dec 12, 2019

2 min read

The One Behavioral Finance Truth All Firm Owners Should Know

May 31, 2022

5 min read