Choosing a Small Business Retirement Plan from a Tax Perspective

Share this

At the risk of sounding like I'm preaching to the choir—retirement planning is essential for small business owners. Whether you are making the transition from being a W-2 employee to starting your own firm or if you already own a business and are implementing a retirement plan, it is important to decide which retirement path best suits your needs. There are many retirement avenues available to small business owners. In this blog, we will compare the Simplified Employee Pension Plan (SEP) with the Savings Incentive Match Plan for Employees (SIMPLE Plan) from a tax perspective. Each retirement plan has unique pros and cons that are important to understand prior to making an educated decision on which plan is best for you—so let’s dive in.

Simplified Employee Pension

Simplified Employee Pension (SEP) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for themselves and for their employees. A SEP plan has lower start-up and operating costs than that of a conventional retirement plan (i.e., 401k) and allows for a contribution of up to 25% of each employee's pay.

Quick Pros

- Simple to implement and is low maintenance

- It can be ideal for businesses with fewer than ten employees

- Offers higher contribution limits than traditional IRAs

- Extended time to contribute, good for cash flows

- No annual tax filing requirements

Quick Cons

- The SEP plan is employer-funded with no option for employees to contribute

- There are no options for taking loans out of the SEP IRA

- Each eligible employee receives the same SEP IRA percentage (no preferential treatment for any particular employee)

- No catch-up provision for older participants to contribute more

- Maximum total contribution limits are 25% of an employee’s compensation (limited to $57,000 in 2020 and $58,000 in 2021)

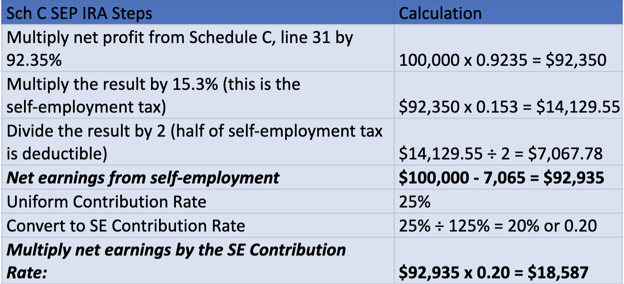

The calculation to determine the maximum SEP contribution is dependent upon your entity type. If you file your business income and expenses on your individual tax return (Schedule C), then your maximum SEP IRA contribution is based on your self-employment net earnings. For example, if your net profit from your Schedule C is $100,000, then your maximum SEP IRA contribution would be $18,587 (see Figure 1).

Figure 1

The maximum SEP IRA contribution has a completely different calculation if your business entity type is taxed as an S Corporation. Unlike a Schedule C, the owner (shareholder) is required to be on payroll and receive wages. The shareholder must pay themselves a reasonable wage in order to retain their S Corporation tax status.

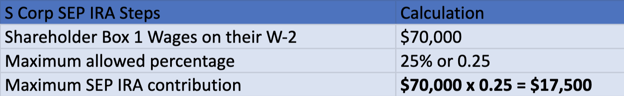

So, let’s now assume the entity from the above example is instead an S Corporation, and the shareholder paid themselves $70,000 in wages. The maximum SEP IRA calculation is quite easy—25% of your Box 1 wages, which is listed on your W-2. In other words, if the shareholder’s Box 1 wages were $70,000, then the maximum SEP IRA contribution would be $17,500 (see Figure 2).

Figure 2

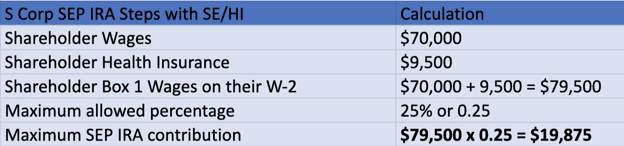

Since the SEP IRA is based on Box 1 wages from the W-2, there may be an additional benefit regarding shareholder health insurance. Since shareholder health insurance is included in Box 1 wages, the maximum SEP IRA amount increases for the shareholder.

Tax Tip: Since shareholder health insurance is included in wages, it is taken as a deduction on the S Corporation tax return. The shareholder health insurance only increases Box 1 wages and is not subject to Social Security or Medicare taxes. This increase in Box 1 wages may appear like it is increasing your individual taxable income, but that is incorrect. Although your wage income is higher on your personal tax return, you simultaneously receive a negative adjustment to your AGI in the amount of the shareholder health insurance—essentially offsetting the increase of W-2 wages on your individual tax return.

Let’s continue with the same example of $70,000 in wages from above but now let’s say the shareholder also paid an additional $9,500 in shareholder health insurance. This would bring the Box 1 wages on the W-2, for the shareholder, to $79,500 and the maximum SEP IRA contribution amount to $19,875 (an increase of $2,375) (see Figure 3).

Figure 3

The S Corporation tax status has an additional benefit—the maximum SEP IRA contribution amount can be determined earlier, which is great for tax planning. Since the maximum contribution amount is 25% of Box 1 wages from the W-2, this amount is known by year-end. Unfortunately, the Schedule C calculation is determined by the net profit of the business and is subject to change if there are last-minute modifications or tax adjustments like depreciation. If you are making a maximum SEP IRA contribution as a Schedule C, it is best to make the contribution once your tax return is ready to be filed.

Whether you are taxed as an S Corporation or Schedule C, the SEP IRA is very flexible regarding cash flows. The SEP IRA doesn’t need to be funded until your tax return deadline (plus applicable extensions). The deadline for a Schedule C filer would be April 15th unless you file for an extension (if extended, the deadline for the SEP IRA contribution would be October 15th). The deadline for an 1120S for an S Corporation would be March 15th unless you file for an extension (if extended, the deadline for the SEP IRA contribution would be September 15th).

Each eligible employee must receive the same percentage between 0% and 25% of compensation. This can be a major drawback for employers that have more than a handful of employees. In addition, only the employer can make contributions, as there isn’t an option for an employee to make their own contributions to the SEP IRA plan.

The SEP IRA can be a useful retirement platform and employee incentive for small business owners. If you would like more information on the SEP IRA plan, check out this IRS resource.

Savings Incentive Match Plan for Employees (SIMPLE IRA)

The SIMPLE IRA is just that—simple. SIMPLE IRA plans can provide a significant source of income at retirement by allowing employers and employees to set aside money in retirement accounts. Similar to the SEP IRA, SIMPLE IRA plans do not have the expensive start-up and operating costs like a conventional retirement plan (i.e., 401k).

Quick Pros

- Simple to establish

- Ongoing maintenance is easy and inexpensive

- Employee contribution limit is $13,500 ($16,500 for those age 50 or older)

- No annual tax filing requirements

Quick Cons

- Mandatory employer contribution

- No ROTH option

- Must establish by October 1st of the preceding year

- No loans allowed

The SIMPLE IRA plan requires the employer to contribute each year. The employer can either:

- Match up to 3% of compensation for eligible employees (not limited by the annual compensation limit) or,

- Make a 2% nonelective contribution for each eligible employee (annual limit of $285,000 for 2020 and $290,000 for 2021)

Establishing a SIMPLE IRA plan can be a relatively easy benefit to set up and aid your employees toward saving for retirement. Unlike the SEP IRA, the SIMPLE IRA has an employee contribution component. An employee can contribute up to $13,500 ($16,500 for those age 50 or older) outside of the employer matching contribution of up to 3%. The SIMPLE plan would need to be established by October 1st of the preceding year unless the company was created after October 1st.

The employer portion (up to 3%) must be matched even if the employee did not fund the SIMPLE IRA evenly throughout the year. If an employee was contributing less than the maximum match amount (or none at all), but later in the year decides to contribute more, the employer must still match the employee contributions up to the predetermined match percentage.

For example, Dan's annual salary is $50,000, and he starts contributing to his employer's SIMPLE IRA plan on September 1st. He contributes $1,536 through December 31st. Dan's employer must match Dan's contributions up to 3% of Dan's calendar-year compensation, or $1,500 (3% of $50,000). It doesn't matter that Dan only contributed to the plan during the last four months of the calendar year.

When it comes to funding the SIMPLE IRA, there are different deadlines based on the type of contribution. The employer matching (or nonelective contribution) must be funded by the due date of the return, including extensions. The employee salary reduction contribution is due within 30 days after the end of the month in which those funds would have been payable to the employee.

Lastly, if you plan to terminate a SIMPLE IRA plan, make sure to plan ahead. Once started in a year, you must fund and maintain your plan for the entire calendar year. Also, all contributions promised to an employee must be funded. According to the IRS, you should notify your employees by November 1st that the SIMPLE IRA plan has been terminated effective the following January 1st.

Tax Tip: Contributing to either a SEP IRA plan or a SIMPLE IRA plan does not preclude you from being able to contribute to an individual IRA account, such as the traditional IRA or ROTH IRA.

The SIMPLE IRA plan can be an easy, cost-effective method to establish a retirement benefit at your company. If you would like more information on the SIMPLE IRA plan, check out this IRS resource.

If you would like to talk to a professional on our team about tax planning, or just get advice, check out XYTS and get in touch with us—we’d love to talk taxes with you!

About the Author

Dan Ritter Jr, CPA, is a Tax Manager for XY Tax Solutions. He brings with him over five years of tax experience and holds a Master of Professional Accountancy from Montana State University. Dan specializes in tax for individuals and small businesses and enjoys helping new and established business owners navigate the world of tax and its benefits. Outside of work, he enjoys camping, fishing, and spending time with his wife and four children.

Share this

- Running Your RIA Efficiently: Outsourcing Bookkeeping with XYPN Books

- Road to Launch with XYPN Member Alan Skillern, CFP®, MBA

- Coaching for Better Time Management: Prioritizing Organic Growth in Your Daily Routine

- Boost Your Financial Advisory Practice: SEO Strategies and CRM Optimization for Sales Success

- Advisor Blog (693)

- Financial Advisors (221)

- Growing an RIA (99)

- Digital Marketing (87)

- Marketing (84)

- Community (81)

- Start an RIA (76)

- Business Development (72)

- Coaching (72)

- Running an RIA (70)

- Compliance (69)

- Client Acquisition (65)

- Technology (64)

- XYPN LIVE (59)

- Entrepreneurship (57)

- Sales (49)

- Practice Management (44)

- Client Engagement (41)

- Bookkeeping (38)

- XYPN Books (38)

- Investment Management (37)

- Fee-only advisor (36)

- Lifestyle, Family, & Personal Finance (31)

- Employee Engagement (30)

- Client Services (25)

- Financial Education & Resources (25)

- Journey Makers (21)

- Market Trends (21)

- Process (14)

- Niche (11)

- SEO (9)

- Scaling an RIA (9)

- Career Change (8)

- Transitioning Your Business (7)

- Partnership (6)

- Transitioning To Fee-Only (4)

- Social Media (3)

- Transitioning Clients (3)

- Emerald (2)

- Persona (2)

- RIA (2)

- Onboarding (1)

- Sapphire (1)

Subscribe by email

You May Also Like

These Related Stories

8 Simple Tips to Optimize Tax Planning as an Advisor

May 9, 2022

6 min read

Year-End Tax Planning: Decisions to Weigh

Nov 30, 2020

9 min read