Your Fiduciary Moment of Truth: Are You a Fake Fiduciary?

Share this

You’re a fiduciary, right? I mean we say it all the time—preach it in fact. Sometimes we use, or perhaps rely on, the term too much. And maybe on occasion, some of us get a little too sanctimonious with it.

But in all of our efforts to “put our clients' interests ahead of our own”, it doesn’t always work out the way we hoped.

My good friend and mentor Mark Ciucci at United Capital describes his fiduciary moment of truth like this:

When something happens (e.g. major world event, market shock, life event good or bad, etc.) how do you determine which client to reach out to first? And how do you know it’s that client? Did your planning application alert you that based on these events, they have fallen in/out of their “confidence zone” and they are the one of many who requires attention? Or did you just casually happen to remember that this client specifically likes/needs to be contacted when these things happen?

And what does this have to do with “putting clients’ interests ahead of our own”?

The reality is, as humans, it’s hard being a fiduciary. This is actually the one area the robots have us. Unlike us, they can be truly impartial because they don’t operate in grey areas—just zeros and ones.

For us humans who, unlike robots, have empathy and emotions, the grey slips in. And as much as we fight it, we can’t be all the right things to all the right people.

(This isn’t meant to scare you, but I do hope this gives you pause and encourages you to look at how you are running your business.)

Let’s examine some scenarios and see how you fare. This is it. This is your fiduciary moment of truth.

Fiduciary Moment of Truth: Continuity and Succession

Congratulations! You’re having a baby! Your clients are happy for you. They truly are. But want to know what they’re really thinking?

They’re most likely thinking about themselves.

“How does this affect me? What if something happens to me while my advisor is on maternity/paternity leave?”

And that’s the happy scenario…

What if you’re on vacation and there’s an accident? What if you get sick? Do you have a continuity or succession plan?

We see it with advisors and planners all the time, both young and old. They have no plan in place in the event of disruption to their firms or their lives.

(Raise your hand if you or someone you know is the product of a failed, non-existent or not-worth-the-paper-it-was-consummated-on” succession plan.)

Financial planners help clients see their own blind spots but so often fail to see their own. If you’re truly putting your clients’ best interests first, then you owe it to them to have a continuity or succession plan in place.

Fiduciary Moment of Truth: All Things to All People

A new couple arrives with a complex situation. The wife is running her own business that’s taking off after leaving the corporate world. The husband’s company, where he is an employee, is about to IPO after merging with a larger tech shop. They moved from California to Austin recently and after renting are now ready to drop roots in...let’s say Tarrytown (because who doesn’t want to live in Tarrytown?). They’re trying to buy in a place where every house sells for well above what it’s actually worth. Oh, and they’re in the midst of still filing their taxes because with the wife's business launch and success last year, and the move on top of that, it kind of slipped by.

They’d be an amazing client.

But is all that in your wheelhouse? It could be. XYPN members are pretty savvy when it comes to advanced planning. But at what cost and could it possibly come at the detriment of other clients? Sure, you’re an expert. But are you really an expert in all those areas?

You know small business planning and executive comp and options pretty well. But how well do you know California's state tax implications? Oh, and then they forgot to mention they want to invest the proceeds from the IPO partially into her business and part of it into “this new social responsible investing stuff.” Are you an expert in that too?

Don’t be afraid to ask. And don’t be afraid to say, “I’m not sure, but I can find the answer”. The membership and forums of XYPN are chock-full of stories just like this and usually, you’re only a few mouse clicks or a few minutes on the phone away from a potential answer (or at least from being pointed in the right direction).

Referring clients away is okay. I’ll repeat: referring away is okay (hat tip to XYPN Executive Business Coach Arlene Moss).

You don’t have to do it all on your own. Just because you’re acting as a “financial coach” or “personal CFO” doesn’t mean you can’t have others in your corner. Tiger Woods and Serena Williams don’t have “a coach” but rather a team to help them perform at their peak.

Don’t get me wrong, I’m not advocating you hire a whole team of people. But all too often we see advisors “skimp” on either A) asking for that expertise or B) being willing to pay for it to address the needs of their clients.

Let’s be honest, it’s hard to be the expert in taxes, investments, and executive comp and stock options. Sure, there are some people who can manage it all, but in my experience, you can be excellent in one to two areas and average in the others.

And this is exactly why you can’t be all things to all people.

Fiduciary Moment of Truth: Planning Without Implementation

A young couple comes to you that is in the middle of this crazy thing we call life. They have a couple of kids, two jobs, student loans, and they just bought their first home and are on the go constantly. Heck, they’ve already rescheduled twice with you. The wife has just finished residency and is about to “make bank.” The husband has had a run of good fortune with a promotion and some recent bonuses and they finally have some scratch to feel they can make progress. They simply want help getting their financial lives in order.

Of course, they can’t agree on how to best fund their kids’ college (or if they even want to because what does college even look like 15 years from now?). They have a low rate on the student loan debt, but there’s a pile of it, so they’re debating how quickly to pay it down. With the promotion and bonus, they’re finally to a point where they feel they can get on track and start preparing financially for the future.

Where do they start first?

After a couple of back and forths, you finally feel you have a strategy that everyone agrees on. You present the plan and say, “Good luck!”

Hold on…good luck?! If you are putting your clients’ interests ahead of your own, don’t you owe it to them to make sure they actually achieve what they hired you to help them accomplish?

This is where things get very grey. You can’t force them to follow or execute your recommendations any more than a doctor can make you “eat right and exercise.” Easier said than done...always.

But isn’t that the value of YOU? If not, wouldn’t they simply be better off hiring one of the many automated planning or investing services? (I realize a mere few paragraphs above we discussed “refer away” but that absolutely doesn’t mean abdicate away.)

As advisors, we need to follow through. Ensure you have the plans and processes in place to give your clients the proper amount of “quality irritation” to actually execute on their plans and achieve the goals therein.

Fiduciary Moment of Truth: Competing on Cost/Being the "Low-Cost Provider"

When did being a fiduciary suddenly mean you have to be the low-cost provider? Why can’t a fiduciary make money...and perhaps even lots of it?

If you’re not charging enough, you could put yourself in some compromising positions. For starters, you could put yourself out of business, which certainly makes it hard to put clients’ interests first because, well, you won’t have any clients. Secondly, if you’re not making enough to make ends meet, you clearly aren’t making the best financial decisions for yourself—so are you really in a position to guide your clients financially?

It’s always good to go back to your clients and understand what is most important to them. Take a client’s portfolio for example. It’s easy to simply say, “We use passive funds like index ETFs, look for the cheapest access point, and this allows our clients exposure to markets at the cheapest cost.” But are your clients really looking for the “cheapest” or are they looking for the “best”?

Remember, you make the same amount of money whether you recommend a 5 bps fund or a 50 bps fund. Use times like these to flex your fiduciary muscles. There's no reason you can't say, “We are always going to look for the most cost-effective solutions, but in this instance we believe this is the best and here’s why.”

Be cost-effective. Don’t gouge people. But know the value of your time, effort, and services. When it comes to people’s money and when the stakes of making a mistake are high, you’d be hard-pressed to find someone who is looking for the lowest-cost provider. What they're really looking for is the highest-value provider. Let that be you.

Fiduciary Moment of Truth: Planning for the Best?

By nature, most financial planners have a tendency to operate out of a place of concern or a need to protect. Yet not all of our clients are that way. Why then should we project our tendencies upon our clients. It’s behavioral finance 101.

Yes, we must be diligent and sometimes protect clients from themselves, so to speak, but we can’t let our own biases slip into the plans of our clients. They're financial plans should reflect their values, not yours.

A great example I often see is in the capital market projections of financial planning software. Now this is a debate much broader than the scope of this blog, but I don’t find a ton of planners who raise their capital market projections too often.

I remember back in 2009/2010 and beyond when the question would arise about “the new normal” and the thought of equity markets returning north of 10%, and putting those projections in your financial planning application. Specifically, planners would NOT run a historical projection using historical rates because that just wasn’t possible and they wanted to be conservative. And they actually lowered future expectations causing many clients to delay or disregard goals for a future that never played out. But I guess you can’t get sued for being too conservative, right?

How many clients didn’t get to live the lives they had hoped because their planner was too conservative in their projections? If one of your client’s goals isn’t to die on a mattress full of money, put their interests first and make sure they don’t. Let them enjoy the good years they have.

Fiduciary Moment of Truth: AUM (Assets Under Management)

I lead an investment platform. You must have seen this coming. And yes, I have a conflict of interest.

So let’s dive right in.

First of all, let’s clear something up right off the bat. Yes, you can be fee-only and manage assets for an AUM fee. And yes, you can be a fiduciary and manage assets for an AUM fee.

It's easy to see that this could be an area where black and white collide to form one of those grey areas for fee-only fiduciaries. The argument is that simply by offering AUM for a fee, you are putting yourself in a compromising position to recommend only your portfolios to your clients versus anything they could potentially invest. As a planner, it’s to your benefit to recommend your clients manage assets with you because you make money on the AUM fee. Yes, you do. The same way planners who offer tax preparation or other services make money on those.

The good news is that if you feel this way, you can simply offer your services on a fee-for-service basis and include AUM at no charge. Or you could punt and have your clients do it themselves. Or, as I said earlier, you could refer it away.

This is where it gets complicated though. Do you really want to put the ongoing execution of your clients’ plan in their hands? Do you really think your clients want never-ending to-do lists? No. They are paying you to take care of all that for them because when it comes to money, the stakes are always high.

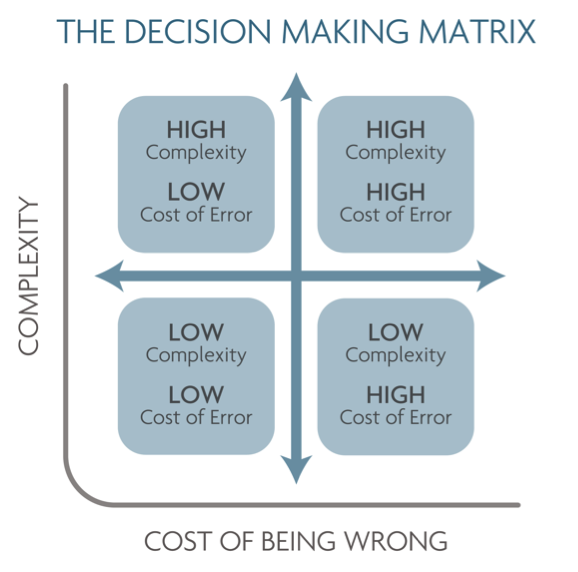

Take a look at this decision matrix from my friend and former colleague Joe Duran:

Source: InvestmentNews

When the stakes and cost of being wrong are high, clients want you involved. That’s why they are paying you!

If you choose to put more of the ongoing implementation on the client, at least be sure you have a system and feedback loop in place to ensure execution. And have an agreement that says you are not responsible for the ongoing implementation in the event they come back and say, “Why aren’t we further down our path? Why didn’t this get done?”

In Conclusion

Being a fiduciary is serious business. You have the financial future of your clients in your hands.

If you are the surgeon, scrub up and use your expert precision to direct the financial future of your clients in the distinct area you are advising.

If you are the general practitioner, have the trusted experts and delegated options and systems at your fingertips to put your clients in the best position to advance on their unique desires and pursuits.

When you tell your clients you're a fiduciary, be sure you can say it not only proudly, but truthfully.

About the Author

A creative innovator and collaborator, Brandon Moss has had a front-row seat to the digital advice revolution, helping build one of the most innovative national RIAs on the planet. He’s acquired a 360* view of the RIA landscape, from being an advisor and running his own firm to designing and integrating some of the most innovative tools in the industry. He has lead, trained, coached, onboarded, integrated, transitioned, (you name it) over 100 RIA firms/wealth management teams. Additionally, he's evaluated, prospected, pitched (again...you name it) countless other firms. Consequently, he's an exceptional listener and comfortable in many different conversations! Occasionally, he's asked to opine on varying topics, typically Gen X+Y, innovation, client experience and technology. Beyond those topics, he's typically “winging it”. Brandon graduated from Texas Tech University's globally recognized personal financial planning program, then made it through some Executive Education at UC Berkeley's Haas School of Business. He’s also perpetually in online classes trying to figure out something new. Brandon resides in the Dallas/Ft. Worth area with his wife, Shelby, and his identical, mirror-image twin boys, Will and Reese. When he's not with them, he's probably in his garage tinkering, building, or buying way too much golf equipment.

Brandon is the Director of XY Investment Solutions (XYIS), XY Planning Network’s digital hybrid investment platform. It’s a turnkey asset management platform (TAMP) designed and curated to the specific needs of XYPN members.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Advisor Blog (722)

- Financial Advisors (245)

- Growing an RIA (128)

- Business Development (96)

- Digital Marketing (96)

- Marketing (93)

- Community (82)

- Start an RIA (76)

- Coaching (75)

- Running an RIA (72)

- Compliance (70)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (49)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- XYPN Books (43)

- Scaling an RIA (42)

- Investment Management (41)

- Financial Education & Resources (32)

- Client Services (31)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (27)

- Journey Makers (25)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Transitioning Your Business (7)

- Sapphire (6)

- Persona (4)

- Transitioning To Fee-Only (4)

- Emerald (3)

- Social Media (3)

- Transitioning Clients (3)

- RIA (2)

- Onboarding (1)

Subscribe by email

You May Also Like

These Related Stories

Are You Making These Common Archiving Mistakes in Your Financial Planning Firm?

Jul 13, 2020

7 min read

4 Essential Tips to Safeguard Your Firm Against Inflation

Aug 1, 2022

6 min read

.png?width=600&height=400&name=PW%20%20Insider%20Insights%20YT%20Thumbnail%20Image%201920%20%C3%97%201080%20px%20(1).png)