8 Questions to Help You Choose Your Niche as a Fee-Only Advisor

Share this

You’ve heard it, you’ve read about it, and I would bet you’ve even seen it in action—I’m talking about the power and importance of identifying a niche within your firm. Identifying and serving a specific niche market sets you up to connect with the people you want to serve most as an advisor, leading to not only increased fulfillment and satisfaction in your work but also increased revenue and growth (more on that below).

So, with all of this to gain from “niching up,” one question still looms large for most advisors: how do you actually choose a niche? This post has eight questions for you to help you get there. But first, we’ll look more at the “why” behind choosing a niche to inspire you with the very real benefits from doing so.

Why choose a niche?

Connecting with clients and your work

Choosing to focus on a specific niche in your firm can redefine the way you relate to prospects and clients and make marketing your services remarkably easier and more rewarding, both in terms of revenue and the satisfaction you get from your work.

Serving a specific niche can:

- Help you identify the people for whom your solution and services fit

- Create an immediate connection to others who have that same passion or experience

- Give you a way to speak directly to the needs of your ideal clients and provide opportunities to share relatable stories and examples of how you’ve helped others in that niche space

- Help facilitate easy and relatable dialogue instead of having to use just questioning strategies to understand a prospect’s pain points and goals

- Infuse your work with a sense of purpose as you serve a niche that is meaningful to you

A marketing advantage

When you hone in on and thoroughly understand the concerns, pain points, and interests of your niche, you can make relevant and valuable content for them when it comes to your marketing strategy. As an example, Michael Kitces’ guest on this episode of his podcast is James Bogart, CEO and President of Bogart Wealth, an RIA located in Virginia. Their firm manages $1.8 billion of assets for 900 households. Kitces recounts how James nearly doubled his firm’s assets under management in a pandemic environment by leveraging educational webinars that addressed issues specific to his niche group, key among them, employee benefits for those who work at specific companies in the energy sector.

When it comes to your marketing, you can’t speak to everyone, so market and speak to a specific group that you resonate with. The better able you are to clarify who you serve, what they need, how your approach helps them, and how you truly understand their pain points and goals, the easier your marketing will be as well as your entire client acquisition process.

Accelerated growth

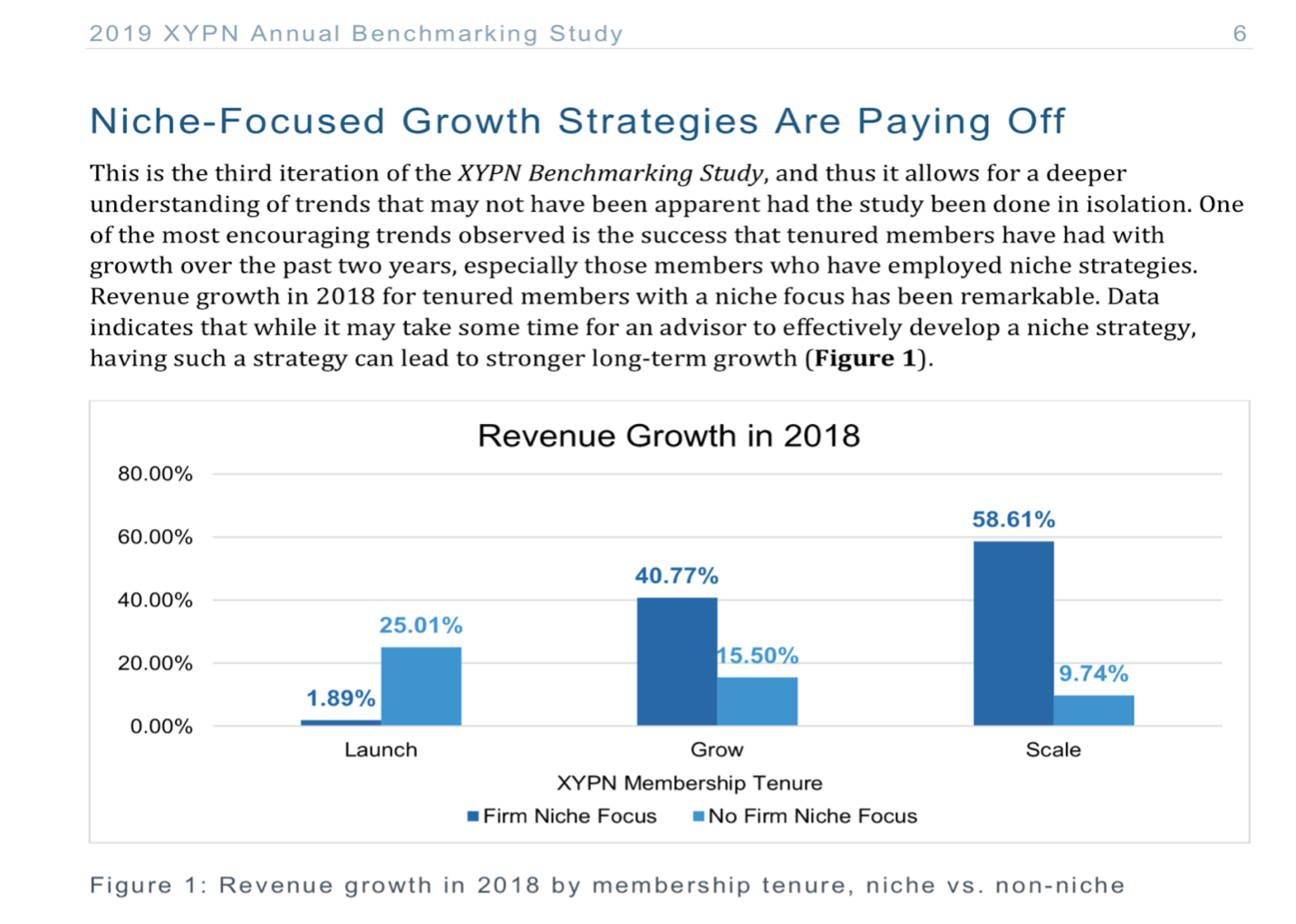

And if all of that’s not incentive enough to encourage a niche focus, let’s get into the data. This graphic from the 2019 XYPN Benchmarking Study might be! With exponential growth for niche-focused XYPN members in the more tenured firm phase, the survey differentiates a 15.50% non-niche vs. a 40.77% niche growth rate!

To further illustrate the power of choosing a niche, industry guru Michael Kitces and client communication expert Carl Richards spell it out beautifully:

“...as the industry has moved towards recurring-revenue model, where advisors are paid for ongoing financial advice, not only has it become increasingly difficult for advisors to stand out in a crowded and competitive marketplace, but as recent Kitces Research shows, advisors who serve a niche enjoy clear operational benefits as well, including the ability to spend more time on high-value, client-facing activities, charge more for the advice they give, scale their practices more efficiently, and earn (on average) more than 50% more than their non-niche counterparts.” –Kitces & Carl Ep 51: Fighting The Fear of Focusing When Trying To Select A Niche

Consider this premise: working to be everything to everyone doesn’t work any better than imagining you could be true friends with an entire city or nation. How many friends do you really need? How many resonate with who you are and your unique personality, interests, and skillsets? And how much time would you have in nurturing a friendship with them all? I’m sure you’ll agree, a silly notion, really. There is no difference in trying to be everything to everyone as a financial advisor.

Turning back to Michael Kitces,

“Ultimately, we find the advisors who are really doing well have some kind of clearly defined niche that makes them easily identifiable and easily referable. It’s sort of counter-intuitive. Most people don’t say, ‘Hey, to do more business, I’m gonna work with fewer people by narrowing the field of clients they serve.’”

It’s safe to say we’ve covered the “why” behind embracing a niche. Now, let’s get to the eight questions that will help you work to identify a niche that fits who you are and what you do best.

8 Questions to Help You Choose Your Niche

1. Where does my passion lie?

Do you love the teaching profession? Have you been a teacher or come from a family of teachers? Do you understand the worries they have that better-managed finances might resolve? Have you “been there” with a spouse who is a teacher or grown up with parents who were committed educators? Passion sells! Communicating passion and your experience within your unique niche is a sure way to align a niche prospect to you. Going off of this example, what might be equivalent to teaching for you? Where does your passion lie?

2. How many clients do I need to run and grow my financial firm?

What are your revenue and/or client acquisition goals? Might a niche you decide upon have enough of those candidates in your town, region, state, or nationwide if you work virtually? Where does the ideal client of your niche market live?

3. What keeps my key niche group up at night, and how might I best deliver to them what they most need?Are you experienced in helping your key avatar group—let’s say it’s teachers—navigate the pain points and challenges they have, helping them reach their goals? With teachers, if navigating pensions is a core challenge or navigating various tax implications, maybe managing student debt and buying their first home in a turbulent housing environment. Do you have the right chops to dig in and help?

4. What is my “secret sauce” as a fee-for-service financial advisor?

Do you have the necessary interest and/or skill sets to serve your desired niche? Are you tuned into their needs, goals, desires, and fears? Have you or can you make a difference to this group of individuals to convert prospects to clients and clients to “raving fans” willing to refer you to their colleagues? Might their referrals provide a sub-niche that is relevant to your skill sets and passions?

5. What success story can I share?

How has your work with other teachers served to both bolster your knowledge and valued expertise as a fiduciary advisor while relevantly aligning with the needs and desires of your prospect? Has focusing on the relevant results you’ve helped others achieve been powerful in working to attract and convert niche clients to being your niche clients?

6. How do I effectively market to this niche to get my firm on the map?

It’s much easier to garner prospect attention when you create a marketing niche with a specific and honed focus. Ask, is your website customer-centric? Does it clearly identify who you serve? Having perhaps been a teacher, can your prospects see themselves in your verbiage and in the photos you share or the stories you relay? Are your prospect’s goals and pain points clearly painted in your collateral materials so you know you’re honed into the people you intend to serve?

7. Can I utilize specific centers of influence associations within my niche?

Can you identify teacher associations and organizations where your key niche group associates? Can you bring value through sharing educational expertise live or virtually to these groups to get you and your firm’s name out as a trusted expert who understands their needs? Might your “call to action” or complimentary white paper address their needs and also encourage them to engage in a complimentary call to learn more about how you might be able to help them?

8. How might I become the “go-to” financial professional best educated to serve the niche group I desire?

Is your niche community one to speak up to others and give you referrals for people who’d benefit from the same great care you provided to them? Are you the preferred educator in this group serving up educational handouts, podcasts, webinars, and informative newsletters to your key niche group? How robust are the communities within your select niche?

On the fear of alienating existing clients

In my XYPN advisor coaching sessions, I’m often asked, “Won’t I alienate my existing clients if I go ‘all niche’ on them?”

Kitces again provides some helpful commentary in his podcast, Updating Advisor Marketing For a New Niche without Alienating Existing Clients.

“...the reality is that for firms that already serve their clients well, the risk of alienating existing clients with a new niche focus is low, as in practice it’s more often the clients who are concerned about whether they will be rejected by the firm, and upon being told of the new niche focus, won’t declare they’re leaving and instead will simply ask “will we still be allowed to keep working together, too?”

In another episode, Kitces goes on to say:

“Ultimately, the key point is that deciding to serve a niche isn’t about saying ‘no’ to a bunch of prospective clients, it’s about getting at least a few more potential clients to say ‘yes’ in the first place. Getting started as a financial advisor (regardless of the business model) is by far the most difficult stage in every advisor’s career.

But the good news is that there is nothing to lose by not trying to be everything to everyone, and a whole lot to gain from getting really good at serving a specific clientele with issues that are unique to them for which the advisor can offer differentiated value.

In the process, advisors can move from not being relevant to each and every person with whom they interact, to being in a position to serve the exact needs of at least a few of them… which, at the end of the day, is a big step forward, both for advisors just getting going, and for advisors who want to take their businesses to the next level!” –Kitces & Carl Ep 51: Fighting The Fear of Focusing When Trying To Select A Niche

Consider interviewing other advisors who have a key niche focus. Ask them how they’re doing, what’s working, did they gain more clients, and is working with a focused segment a boon in their business process flow or not. I’m fairly certain of the answer you’ll find. When it comes to the question of whether to choose a niche for your firm, I’ll echo what the athletic shoe giant Nike boasts with great confidence, “Just Do It!” I know you’ll be glad you did!

Worthy niche-related resources:

How to Better Attract your Ideal Clients by Crafting A Specific Client Persona to Market To with Michael Kitces and Katie Godbout

Why It's Easier to Market to a Financial Advisor Niche with Michael Kitces

Why Niche Marketing Will Make or Break Advisors' with Michael Kitces

Scaling $1B Of Organic Growth In Under 5 Years With Targeted Multi-Niche Online Education, With James Bogart with Michael Kitces

Equity Compensation Planning As A Niche: Market Opportunity And Differentiated Value with Michael Kitces

Kitces & Carl Ep 51: Fighting The Fear of Focusing When Trying To Select A Niche with Michael Kitces and Carl Richards

Updating Advisor Marketing For A New Niche Without Alienating Existing Clients with Michael Kitces

.png?width=256&name=500x500%20(1).png) About BB Webb, XYPN Sales Coach

About BB Webb, XYPN Sales Coach

XYPN Sales Coach BB Webb boasts an impressive background in the arts and as an entrepreneur. She first dipped her toe in the world of sales while touring her one-woman play across the country, and then dove in headfirst as the founder of an award-winning Atlanta-based special event venue. In 2014 BB published her book, Build Your Business: BB Webb’s Notes From the Highwire and has worked as an Executive Coach with small business owners.

BB’s goal is to help XYPN members build great relationships, plans, and processes for sharing their services as financial advisors. With a focus on consultative selling, her programs are designed to guide advisors in having meaningful conversations with prospects and sharing their value fearlessly and with joy.

Share this

- Advisor Blog (721)

- Financial Advisors (244)

- Growing an RIA (128)

- Business Development (95)

- Digital Marketing (95)

- Marketing (92)

- Community (82)

- Start an RIA (76)

- Coaching (74)

- Running an RIA (72)

- Compliance (70)

- Client Acquisition (68)

- Technology (67)

- Entrepreneurship (64)

- XYPN LIVE (64)

- Fee-only advisor (49)

- Sales (49)

- Bookkeeping (46)

- Client Engagement (45)

- Practice Management (44)

- XYPN Books (43)

- Scaling an RIA (42)

- Investment Management (41)

- Client Services (31)

- Employee Engagement (31)

- Financial Education & Resources (31)

- Lifestyle, Family, & Personal Finance (31)

- Market Trends (26)

- Journey Makers (24)

- Process (18)

- Niche (13)

- SEO (9)

- Career Change (8)

- Partnership (8)

- Transitioning Your Business (7)

- Sapphire (6)

- Persona (4)

- Transitioning To Fee-Only (4)

- Emerald (3)

- Social Media (3)

- Transitioning Clients (3)

- RIA (2)

- Onboarding (1)

Subscribe by email

You May Also Like

These Related Stories

Financial Planning SEO: How to Help Your Niche Find You

Jan 22, 2024

5 min read

Moving Beyond “Fee-Only” by Building an “Advice-Only” Firm

Jul 25, 2022

4 min read

.png?width=360&height=188&name=WWAS%20(1).png)

.png?width=600&height=400&name=PW%20%20Insider%20Insights%20YT%20Thumbnail%20Image%201920%20%C3%97%201080%20px%20(1).png)